Online loans aid people who do not have enough credit score and time to spare but require financial support quickly and legally. A fixed amount of money can be borrowed from online loan providers who do it without a thorough credit check. Small payday loans online loans no credit check ensure a quick approval loan to help a borrower instantly and offer them a pre-determined schedule for the loan’s repayment.

What are Small Payday Loans Online No Credit Check & How Do They Work?

Getting an approved loan using the traditional process is severely inconvenient due to its increased complexity and tons of requirements. That is why people who are in immediate need of financial help, often turn to the simple and quick process of acquiring online loans with no credit check. This type of loan is also known as online payday or small payday loans online no credit check in Oregon.

As mentioned earlier, the old way of securing a loan might take a considerable amount of time for approval because it involves dozens of steps including a credit check to ascertain whether the borrower is capable of repaying the loaned amount or not. A majority of people do not have a credit score that would impress a bank or any other financial institution that provides its clients a loan.

There are several reasons why one does not have a perfect credit score such as late payment of bills, charge-offs, etc. and this leads people to look for an alternative solution such as small payday loans online no credit check direct lender. There are certain considerations to keep in mind before you proceed to take an online loan despite having bad credit, for example, the credibility of the loan provider, all interest and fees applicable, the flexibility of the loan repayment schedule, etc.

Features of Small Payday Loans Online No Credit Check

Before you get hopeless of traditional loan providers due to having a low credit score, it is better to try every single available route for getting approved no credit check online loans. There are several no credit check online installment loan providers currently active in the USA that help out their clients financially and also reduce the gap between verified lenders and borrowers. Following are some of the most common features related to small payday loans online no credit check instant approval:

- Fee

A predetermined fee is applicable on every online loans with no credit check that you get from a reliable online loan provider. The total cost of such a loan is calculated by considering the applicable loan fee and interest rate.

- Fast approval

The main reason why small payday loans no credit check loans are so popular among borrowers with low credit score is the speed of its approval. This type of loan is approved way faster than traditional ones and in some cases, an online installment loan is processed to the borrower’s account on the same day of application.

- APR

It is imperative to research every feature of online loans with no credit check such as its APR. APR affects the overall monthly payment so make sure these remain affordable for you because you should not take out a person’s online loan on a whim.

Eligibility Criteria for Small Payday Loans Online No Credit Check

The rules for acquiring small payday loans online no credit check in and around NC differ when it comes to who can take advantage of these services. Lenders that specialize in offering online no credit loans often share details of the eligibility criteria on their website. It is common to have a loan approved when you have a credit score equal to or above 620 but if it is lower, then you need to find a trustworthy online loan provider that considers you an eligible borrower. An applicant usually has to fulfill the following criteria to secure a no credit installment online loan:

- 18 years or older

- Must have a valid contact number and email address

- Must have a valid United States bank account

Typical Costs of Small Payday Loans Online No Credit Check

Individuals with bad credit must avoid getting any type of online loan that must be repaid according to a fixed schedule without knowing its total costs. The total costs depend on various factors and there might be a significant difference based on the loan provider that you have chosen to go with.

The maximum amount allowed for borrowing is also capped in the case of most of the verified online loan providers but Heart Paydays is a broker whose affordable APR ranges from 5.99% to 35.99%. Following are the costs that should be considered and included in the total cost of online loans no credit check

- Interest rates

One should learn about the difference in the rate of interest of installment loans and normal loans before applying. Lenders would offer a certain interest rate (anywhere between 5.99% and 35.99%) before the loan process any further.

- Transfer fees

An online lender can charge borrowers a transfer fee which is meant to transfer their existing debt from some other institution. Mostly used by credit card companies, this is included in the total costs of small payday online installment loans in some cases.

- Penalties

Penalties are levied only when the borrower fails to repay the loan within the allotted timeframe. Penalties are a combination of different types of fees like late, prepayment, origination, and insufficient funds fees.

How to Apply Loans for Small Payday Loans Online No Credit Check in Quick Steps?

Most of the time, people who need instant bad credit loans get mislead by the complicated procedures of application. But heartpaydays.com provides an easy way to apply for online loans no credit check quickly and conveniently that takes only a couple of minutes to complete.

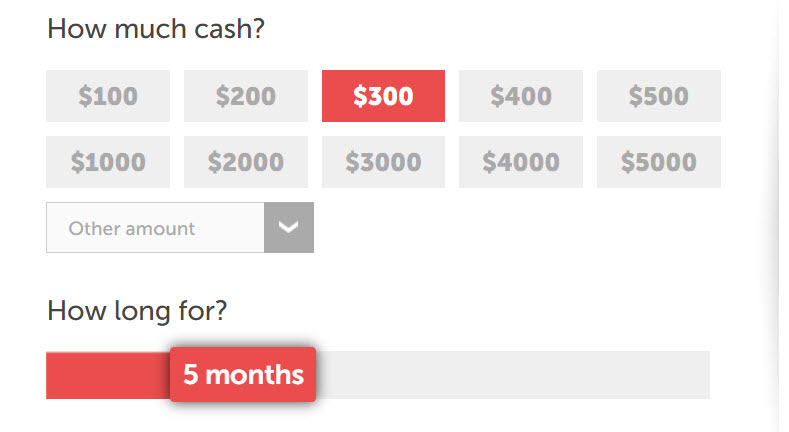

Step 1: Choose an appropriate loan amount

Applicants must carefully select a loan amount before they start filling up the application form. This step could take a day or two depending on how long it takes for someone to calculate the exact amount that they require as a loan. Heartpaydays.com as a lender offers up to $5,000 to borrowers who wish to opt for online installment loans without requiring a credit check.

Step 2: Filling up the loan application

Submitting the loan application seems a bit confusing to all first-time borrowers who choose small payday online loans with no credit check. But heartpaydays.com simplifies this step by introducing a quick and easy online loan application that requires minimum details from you. Once it has been filled with information and the desired amount of loan needed, you can submit it to proceed.

Step 3: Awaiting a response from lenders

Once a completed loan application has been submitted, borrowers need to wait for heartpaydays.com to find them verified and interested lenders. These lenders are connected with the heartpaydays.com platform after running a background check to ensure their financial capabilities. The decision to accept or reject a certain loan application depends on lenders after the borrower’s personal information is shared with prospective lenders.

Step 4: Receiving the loan

Once all of the aforementioned steps are completed efficiently, the only thing left for borrowers is to receive their loan instantly. Heartpaydays.com ensures that applicants are notified once their loan request is accepted and when the loan is credited to their valid US bank account.

How to find the best Small Payday Loans Online No Credit Check in the USA?

It is normal to feel a bit skeptical of small payday loans without credit checks in the USA when there are so many loan providers that go an extra mile to bring easy and instant personal loans to people who need them. But the harsh truth is when you have a bad credit score, there are not many legal alternatives available.

Brokers like heartpaydays.com and some other online loan providers act as a perfect solution under these circumstances. Applying to such platforms gives you a better chance at securing an online bad credit installment loan without getting in any sort of legal trouble later on. A decent amount starting from $100 up to $5,000 can be obtained through heartpaydays.com provided that the borrower has the financial capability to repay the loaned amount within the stipulated timeframe.

The best thing about using heartpaydays.com is the option to browse through several loan programs to find one that works for you. One can easily compare the different closing costs, intricate details, approval time, and interest rates for these loan plan to find the best one. You can even assess each of the different lenders available through heartpaydays.com to improve the chances of your application getting accepted in less time.

Conclusion

Although there are several options in front of borrowers online but choosing a broker like heartpaydays.com is recommended by both first-timers as well as experts. This platform is definitive in nature where you can find and connect with numerous verified lenders. Online installment loans without credit check are just one of the many products they offer to people who are close to losing all hope of finding financial help during their times of need.

FAQs

How Can I Apply with Loan Providers That Will Provide Guaranteed Approval?

One could easily apply for a guaranteed approval loan with no credit check if they follow every guideline laid down by the loan providers on their website. For example, the website of broker heartpaydays.com provides detailed information to help borrowers apply for an online loan easily.

How Much Money Can I Borrow in Installment loans?

Different types of loan providers have varying loan amounts available for borrowers using their platform but most of them do not exceed $5,000. On heartpaydays.com, users are allowed to take out installment loans for $100 to a maximum of $5,000 which is light on a person’s pocket and even easy to repay within a pre-determined schedule.

How Much Interest Will I Have to Pay on My Installment Loan?

Depending on the lender and loan amount that you have chosen, the interest rate for repayment keeps changing. In the case of heartpaydays.com, the interest rate offered to borrowers lies between 5.99% and 35.99%.

Can Applying for Multiple Loans affect My Credit Score?

A lot of people worry whether taking out multiple loans from a provider would not end up looking good on their credit score but that is far from reality. A person can acquire more than one installment loan at a time without affecting their credit score. Your score dwindles only when borrowers fail to repay the loan within the allotted time.

Where can I get an installment loan with no credit check?

Within the US, thousands of online loan providers offer their services in the form of easily accessible installment loans with no credit check for individuals who have a bad credit score. Instead of following the traditional route, it is possible to get an installment loan from a legitimate broker like heartpaydays.com.

Can I Have Multiple Installment Loans?

Yes, you can take out multiple loans from a lender but only if you fulfill the required criteria. It is also important to keep in mind that you do it when you can afford it because in the end all of the loan amounts must be repaid to the respective lender including interest, fees, etc.

Can I apply for an Installment loan with bad credit?

Banks and other financial institutions would give you hard time when a person has bad credit. In case when they require an installment loan, they have to reach out to an online installment loan provider that specifically caters to people with bad credit. Brokers like heartpaydays.com are a one-stop solution to apply for an installment loan with bad credit.

Can I get a same-day deposit or payout?

Although it might seem a bit hard to believe same-day deposits and payouts are quite possible when you apply for an installment loan online without a credit check. The process exempts the painstaking step of checking the borrower’s credit history, so it takes very little time for completion, approval, and eventually payout. The loan amount is deposited into the bank account of the applicant as soon as a lender accepts their request.