It is plausible to be at the pinnacle of your life only to be brought tumbling down by a financial crisis suddenly. While taking out a loan may be a time-consuming and complex procedure, guaranteed loan approval with no credit check is the best alternative when you require financial assistance immediately. Getting a personal loan might be tough when your credit score is reflecting a poor status, but it doesn’t imply you have no other choices to opt from. Individuals can easily search by the term ‘guaranteed loan approval no credit check near me’ as a viable option and choose a suitable no credit check loan in this scenario.

What is Guaranteed Loan Approval No Credit Check & How Do They Work?

A loan stands for a debt provided to a person by a bank or financial organization in exchange for a fee. There are many sorts of loans that are available depending on the credit score of the applicant. A no credit check is what its name implies; while most loans require a full credit check to ensure repayment, loans with no credit check do not require significant credit inspections.

Installment loans include vehicle loans, mortgages, and personal loans that have a predetermined repayment schedule. Even when installment loans are widespread, not all of them offer favorable conditions. Applicants with good credit may find it simpler to apply for a loan and perhaps receive a lower interest rate. However, if your credit score is low, you may be forced to take out an installment loan with an increased interest rate and higher costs.

In simple terms, bad credit installment loans are loans tailored to those who have poor credit ratings, an unstable credit record, or none. Monthly installment loans with no credit check from direct lenders are ideal for individuals with bad credit. They are granted on the basis of your ability to repay the loan. Lenders, for instance, might examine your bank accounts or previous paycheck slips to determine how much money you earn and how much debt you can repay.

Examples of Guaranteed Loan Approval No Credit Check

Guaranteed Loan Approval No Credit Check for Poor

It is challenging for a prospective debtor with a bad credit score to get accepted for tribal loans online applications or any other financial needs. If a person or business is unable to pay their debts, they may be compelled to declare bankruptcy in order to obtain legal protection. Because bankruptcy proceedings are complicated, most lenders are hesitant to lend to debtors who have a record of bankruptcies involving their financial status.

In such a scenario, the inability to pay the amount can turn out to be challenging for most entities with poor financial status. A no credit installment loan can be a boon to such cases where regardless of one’s credit history they can take loans from various lenders.

Guaranteed loans approval no credit check for a guarantor

A guarantor is a terminology used in finance to describe someone who agrees to cover a debtor’s loan if the borrower defaults on their loan agreement. Despite the fact that the loan application procedure has been streamlined, banks often remain stringent when it concerns getting approved. Thus, if it is complicated for those with good credit to have a loan authorized, it is nearly impossible for individuals with poor credit to receive any loan.

Individuals with low credit might seek alternative sources or means such as different brokers for obtaining loans in such cases. An installment loan with no credit check guaranteed approval is what people with bad credit scores might consider in this scenario. As these loans require no guarantor or strong credit score, brokers like Heartpaydays.com might be the best solution here.

Features of Guaranteed Loan Approval No Credit Check

An ‘installment loan’ is a phrase that comprises the vast percentage of personal and business loans given to debtors. For loan acceptance and affordability, each lender establishes its very own parameters; as a result, if you have bad credit, it’s highly unpredictable what APR you’ll be charged for a credit line.

- Guaranteed approval regardless of one’s credit background

Loan approvals with no credit check ensure you lend the required fund without any inspection of your credit history. Guaranteed approval installment loans with no hard credit check are thus ideal for people with poor credit scores.

- Prompt approval of the loan

These loans are known to be approved quickly compared to other procedures apart from a no-background-check facility. The tenure usually varies by lender to lender, however, most accepted loans are credited to your account the very same day. Certain banks, however, do not accept quick payments and thus many people shift towards brokers to get their loan approved as a broker merely acts as a mediator by assisting clients in locating the appropriate lender for their needs.

- A higher rate of interest

Interest rates and periods mostly vary by lender, but guaranteed installment loans with bad credit usually have increased rates. Lenders frequently offer customers with bad credit greater interest rates than those with good credit.

- Flexible loan amounts

Bad credit installment loans usually come with features like any other loans with installment. Here the loan amounts usually range between a few hundred bucks to a few thousand. For instance, Heartpaydays.com offers up to $5000 to individuals with poor credit score by simply filling a brief online form.

Charges and Penalties for Guaranteed Loan Approval No Credit Check

In terms of charges associated with installment loans, interest, repayments, and fees for credit insurance rates as well as interest paid on borrowed premiums, make up the cost of an installment loan in total. The annual interest earned by an amount billed to debtors or paid to investors is known as the annual percentage rate or APR. APR is a ratio that indicates the real annual cost of money over the course of a debt or investment.

- Fees: Debtors are typically required to pay additional costs related to interest rates, such as application processing, loan generation, and other extra penalties such as late payment fees.

- Interest: The borrower repays a part of the loaned principal as well as interest on the mortgage with each installment payment.

Lenders under Heartpaydays.com offer APR rates from 5.99% to 35.99% where borrowers can take the benefit of the service without paying any additional fees regarding registration fees.

Coming to the penalties, the inability to make a repayment on an installment loan tends to make a worse situation as time goes on. They also vary somewhat depending on the regulations set by the lender and the signed contract. The creditor may also regard you to be in default on your debt at a certain time. This usually happens after you’ve been late on your installments for a long time.

Eligibility Criteria for the Guaranteed Loan Approval No Credit Check in the USA

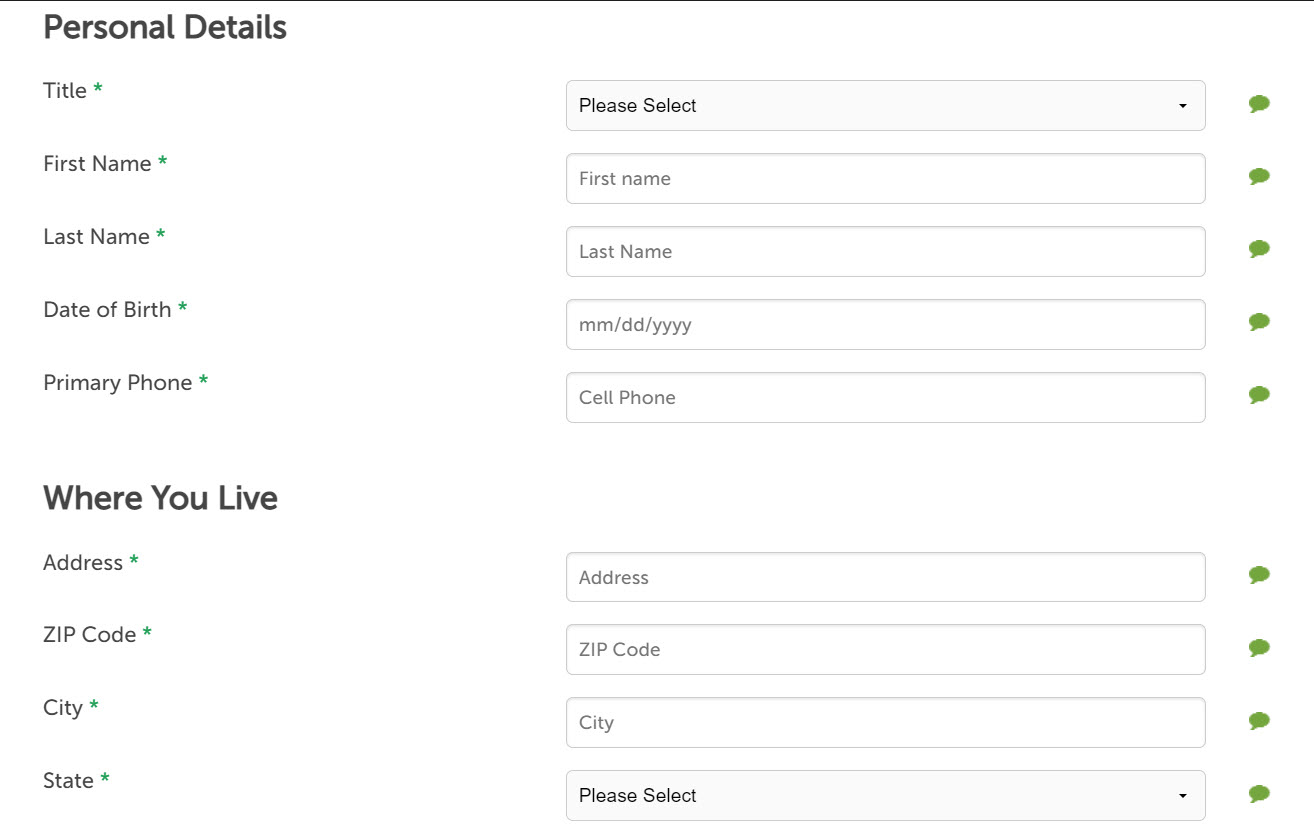

As mentioned earlier, the lenders while granting a loan approval with no credit check require no hard credit score to issue the debt. While as for the eligibility criteria, it may vary from lender to lender apart from the basic requirements such as the age details, applicant’s name, and more.

In the case of Heartpaydays.com, the online provider for bad credit installment loans, the eligibility standards are the following.

- The candidate must be at least eighteen years old.

- The candidate must have a working cell phone and an e-mail address.

- The candidate must have a bank account in the U.S.

How to Apply Loans for Guaranteed Loan Approval No Credit Check in Quick Steps

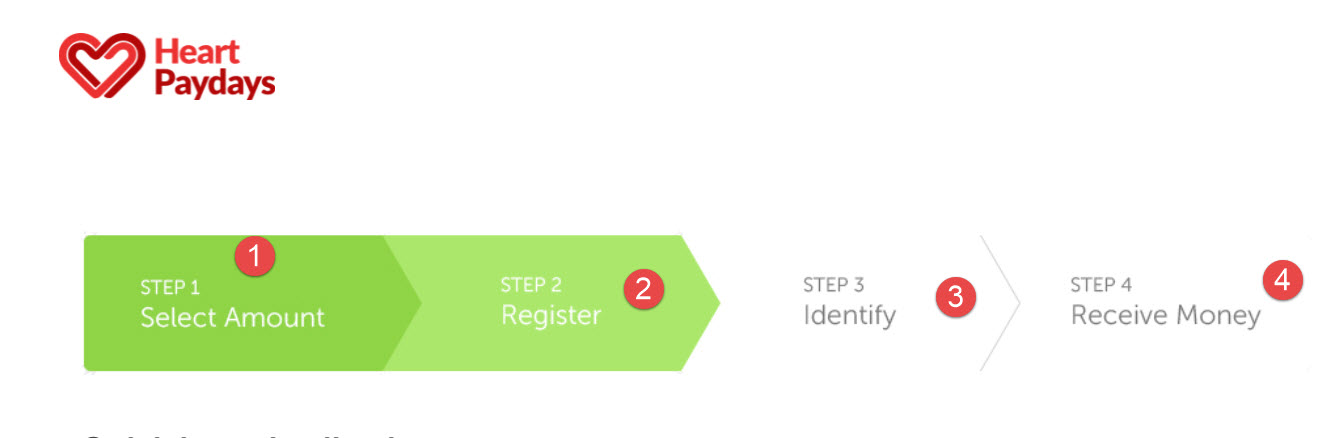

Following is the detailed step-by-step guide to applying for a no credit check installment loan at Heartpaydays.com

Step 1: Choose your loan amount

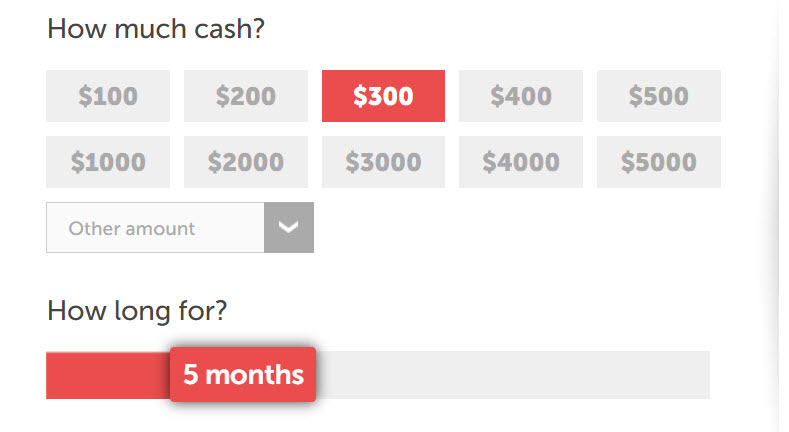

The foremost consideration to consider is determining the required loan amount. At heartpaydays.com, borrowers may get up to $5000 as a loan amount from an appropriate lender.

Step 2: Complete the application form

Heartpaydays.com provides a seamless and prompt process while requesting a loan. They simply need to fill up a short online form to proceed further, entering the amount they would like to borrow.

Step 3: Wait for a decision

Upon filing the application, the candidate needs to wait till heartpaydays.com locates a suitable lender where the creditor has the last say about whether or not to grant the credit. Heartpaydays.com does not conduct verifications on candidates, the creditors with whom they are connected may utilize an external credit reference source to determine a given individual’s probability of getting a loan.

Step 4: Get your loan

Upon the fulfillment of the application with all the above-mentioned procedures the candidate will receive confirmation that the loan amount has been authorized, as soon as the provider has performed authentication on the documentations.

How to find the best Guaranteed Loan Approval No Credit Check in the USA?

Individuals with bad credit may discover many creditors who offer bad credit loans in the existing market scenario. An applicant’s chances of obtaining a loan authorization rise dramatically when they use a brokerage like heartpaydays.com. They are no more at the hands of a single lender’s decision on their application. They have a better chance since heartpaydays.com links them with a suitable provider without anyone needing to put in any additional work.

Conclusion

Opting for Heartpaydays.com can in turn be beneficial as the online provider is in collaboration with several creditors. This not only facilitates applicants to get the loans from the ideal lender but also saves them from facing any hassle due to their bad credit scores.

FAQs

How Can I Apply with Loan Providers That Will provide guaranteed approval?

You must pass the eligibility criteria while applying for a loan; for instance, heartpaydays.com requires applicants to be above 18 years old, have a working cell phone connection or email address, and have a valid account in a US bank.

How Much Money Can I Borrow in Installment loans?

Applicants may borrow from several hundred to thousands of dollars as a loan. In terms of heartpaydays.com, one can avail up to $5000 as an installment loan.

How Much Interest Will I Have to Pay on My Installment Loan?

Lenders employ several ways to charge interest in order to maximize revenues. You need to consider certain information regarding the loan amount, the rate of interest, and the total tenure you will be repaying the loan.

The following calculation may be used to determine your total interest: Principal loan amount x Interest rate x Time (Number of years in term) = Interest

Can Applying for Multiple Loans affect My Credit Score?

Yes, as multiple simultaneous requests in a brief span of time might indicate credit risk, making too many queries for various forms of credit may reduce your credit score.

Where can I get an installment loan with no credit check?

Heartpaydays.com provides installment loans with no credit check & guaranteed approval.

Can I Have Multiple Installment Loans?

You might well have numerous personal loans with various providers or several personal loans with the same lender.

How Do I know if a Lender is Legitimate or a Scam?

Considering certain factors such as demanding a prepaid credit card, having no valid address, lack of transparency about the charges can save you from a possible scam when it comes to debt lenders.

How can I apply for a Guaranteed Unsecured Personal Loans No Credit Check loan near me?

At heartpaydays.com you can apply for easy loan approvals with no credit check that may take a minimum amount of time compared to direct lenders and banks.

What do 12 monthly installments mean?

Under this option, the lender provides you the opportunity of paying the entire price in 12 equal monthly installments.

Can I pay the installment with a debit card?

No, installment loans do not support repayments through debit cards.

What is an installment loan example?

Car loans, home loans, personal loans, and student debt are all types of installment loans.

Is Bad Credit Personal Loans Guaranteed Approval No Credit Check Right For Me?

This may vary on multiple factors including the eligibility factor, your loan requirement, and the status of your credit score.