Contrary to popular belief, not all individuals who have a low credit score or bad credit history are in a dire financial situation because of their own faults. As the cost of transportation, healthcare, and other essentials have considerably risen especially in the last few years, many individuals find themselves struggling with paying for expenses such as education, pension schemes, personal insurance, emergency expenses, unexpected healthcare costs, and other discretionary expenses.

The majority of individuals falling under this category have had their credit scores hampered by a variety of factors. It is almost impossible for such individuals to get loans from traditional sources such as banks and financial institutions. Luckily for them, a class of lenders and brokers specifically provide no credit check installment loans for such predicaments.

What are No Credit Check Installment Loans & How Do They Work?

There are numerous lenders and brokers that offer guaranteed loan approval with no credit check. They are mostly small to medium-sized loans given in the form of installment loans to people who are struggling with a low credit score. Most of these loans are unsecured, as they do not require collateral from the credit-challenged individual. These loans are characterized by their high-interest rates and fast, unrestricted loan approval from lenders.

Bad credit personal loans with guaranteed approval and no credit check involve certain terminology that might be helpful for borrowers to understand beforehand. Some of them are mentioned in brief below.

- Principle amount: This refers to the granted loan amount by the lender to the borrower.

- Interest rate: This is the amount charged by the lender to this installment loan service to the borrower. It is usually expressed in the form of APR or annual percentage rate, which is a combination of the loan fees and interest rates.

- Repayment term: This is the repayment schedule that the borrower has to adhere to. This is explicitly agreed upon in the terms and conditions before the loan is being granted.

- Loan fees: These are the fees that go towards the additional costs associated with the loan such as late payment fees, origination fees, and others.

The overall loan amount depends on the loan term, the interest rate, and the principal loan amount. The principal is spread equally over the scheduled term. Private personal loan lenders without credit checks offer a way out for individuals who have been shown the door by other credit sources. They are usually short-term in nature and are easily accessible thanks to less rigid criteria.

Examples of No Credit Check Installment Loans

No credit check installment loans can come in different forms as specified by the lender’s terms and conditions. To provide a better insight into the types of loans available in the market, here are some examples explained in brief below.

No Credit Check Installment Loans for bad credit

No credit check Installment Loans for bad credit come in handy for individuals who have been denied access to credit. These are ideal for individuals going through unprecedented financial management problems due to irregular work schedules and temporary sessions of unemployment. Such individuals who are usually judged harshly by credit bureaus come from mostly low-income working families.

For these individuals who are excluded from access to bank accounts, housing, critical utilities, and participation in the credit economy, applying for a private personal loan from lenders without credit checks is the only option.

No credit check tribal installment loans

For the uninitiated, tribal loans are a form of no credit check installment loans provided by lending entities based on tribal native-American land. The Consumer Financial Protection Bureau (CFPB) does not define tribal installment loans and thus the terms don’t have any legal meaning.

As Indian ( native Americans) reservations are sovereign nations as defined by the American constitution, loans from lenders falling under this category usually offer less robust consumer protection schemes.

No credit check tribal installment loans, direct lender

Tribal installment loans with no credit checks are generally similar in nature to most other installment loan plans for bad credit. However, the only difference is that the direct lenders associated with tribal loans do not come under the jurisdiction of most federal and state laws.

Tribal installment loans are fraught with more risk as compared to normal installment loans. These risks include challenges in loan refinancing, loan discharges in bankruptcy, and a general problem with an assertion of rights from the point of view of the borrower.

No credit check tribal installment loan by phone

Many tribal lenders offer services exclusively through phones. They do not have a proper online presence, nor do they have a physical office. Borrowers should steer clear of such lenders as their terms and conditions are normally too vague and with added hidden fees.

It is thus always better to consult lending brokers and find numerous lenders under its networks. For example, at Heartpaydays.com, all the lenders provide clear-cut rules and regulations with no hidden fees.

No credit check tribal installment loans for business

Business entrepreneurs can find themselves in a tough financial position without good credit history or credit score. These entrepreneurs may have a compromised credit accessing ability that disqualifies them from most options.

These individuals can opt for tribal installment loans from tribal lenders. However, they must be careful regarding the terms and conditions and look out for any hidden fees. The best option here would be to go for installment loan brokers instead of tribal loans.

No credit check tribal installment loans for students

Students in the US sometimes fall into bad financial situations due to the steep costs of tuition and hostel fees. These individuals usually do not have a good credit score which disqualified them from most sources of credit.

However, tribal loans are high-risk financial products that do not come under the jurisdiction of any federal or state laws. The lenders may undertake unconventional practices when the loan is due for repayment. This is why students should look towards individual lenders or brokers that can offer student-friendly bad credit loans.

Unsecured installment loans with no credit check

Most no credit check loans are unsecured as they do not require any collateral from the borrower. Most of these lenders grant the loans by either looking at the individual’s repayment ability or some other factors.

Brokers such as heartpaydays.com can provide a comprehensive list of different lenders. The broker aims to connect their clients to the most appropriate loan deal for them.

Guaranteed Loan Approval No Credit Check for Poors

Some of the most vulnerable people when it comes to credit access are low-income households. These individuals are normally barred from applying with most banks and financial institutions. They may have several bills to pay which they cannot delay any further.

Bad credit loans emerge as the only option for such individuals. These loans provide them with a gateway towards financial relief in exchange for a higher interest rate.

Guaranteed loans approval no credit check for a guarantor

A loan guarantor refers to an individual who agrees to carry the responsibility of someone else’s payment of debt. The guarantor is equally responsible for paying off the loan but should not be considered a co-borrower. Bad credit loans normally do not require guarantors.

Features of No credit check installment loans

The terms and conditions of no credit check installment loans depend on the broker chosen. However, almost all of them have some features in common that make them different than other forms of traditional loans.

- Types of loans

Installment loans are usually non-collateralized. This means that the loans do not require the borrower to put down an asset to access the loan. Lenders that offer no credit check loans normally do not have such stringent requirements and are unsecured in nature. This further expands their client base as they can provide credit to individuals who have no options left.

- Payment terms

Normal installment loans contain clear terms and conditions for borrowers to understand. Almost all of the installment loans have repayment schedules that are divided across several months. However, the advantage of installment loans for bad credit is that the borrower can repay the loan back before its stipulated time. This allows them to save significantly on interest rates which are particularly high for these loans.

- Provides unrestricted access

Due to the nature of these loans, the criteria are less rigid as they are aimed at low-income or less credit-worthy individuals. Choosing a lender or broker for guaranteed unsecured personal loans with no credit check increases the chances of the individual receiving the loans. Most lenders provide multiple repayment options from which the individual can choose.

- Higher Interest rates

These loans are characterized by high-interest rates compared to traditional loan forms. This is due to the amount of risk that the broker or lender is taking in when granting loans to credit-challenged individuals. The total expenses that a borrower will be expected to pay to a lender are highlighted by its APR or annual percentage rate. Lenders for bad credit installment loans typically carry APRs ranging from 5% to upwards of 40%.

Typical Costs for No Credit Check Installment Loans

The costs for taking out a loan can be subdivided into many parts which include the interest rate. Borrowers can evaluate a lender’s terms and conditions properly if they have a clear idea about the fees and other expenses that are involved.

- Interest Rates

One can get the amount of interest payable by multiplying the loan amount borrowed with the interest charge. For instance, a 15% interest on a $3750 loan would equal 3750x.15= $562.50. The APR, which is used to determine the costs of any lender is calculated by dividing the amount of interest by the loan amount and multiplying that with 365. Next, one has to divide that number by the length of the loan repayment term and multiple it with hundred.

- Application processing fee

This is a fee charged by lenders to cover the cost of processing the application. Some brokers also charge application fees for connecting their clients with a lender under their network.

- Loan origination fee

This is also charged by lenders and brokers as compensation for executing the loan. It is usually expressed in terms of a small percentage of the borrowing amount.

- Late payment fees

There are different kinds of late fees that may be levied by the lender on individuals failing to pay their loan amount on time. This can be in the form of both monthly or annual payments. These are usually high and are meant as a deterrent for borrowers to pay the loan amount on time.

At Heartpaydays.com which is a leading broker for bad credit loans, clients have the option of choosing loan packages from lenders with APRs ranging from 5.99% to 35.99%.

Eligibility Criteria for the Bad Credit Personal Loans Guaranteed Approval No Credit Check in the USA

The United States is one of the most credit-friendly countries in the world but the eligibility criteria for normal loans involves a lot of state and federal laws. Most credit sources such as banks and other financial institutions judge an individual’s creditworthiness by looking at his/her credit score or credit history.

The problem occurs with individuals particularly from low-income households who have suffered a dip in their credit scores. Sometimes these dips can be caused by no fault of their own, leaving them scrambling for paying day-to-day bills. These individuals are also disqualified for applying for a loan from a traditional source, simply based on their credit score.

Luckily for them, private personal loan lenders without credit checks exist to give these individuals financial relief. One of the best things borrowers can do is to choose a broker such as Heartpaydays.com that works with a network of different lenders.

At Heartpaydays.com, the eligibility criteria are simple and clear and can be explained in the following points.

- The borrower has to be a United States citizen and holder of a US bank account.

- He/she must be a minimum of 18 years of age when applying for the loan.

- He/she must have a valid phone number and email address.

How to Apply Loans for No Credit Check Installment Loans in Quick Steps

The steps for applying for a loan can differ from lender to lender. The borrower first has to determine whether he/she will work with a lender or a broker. Because of internet connectivity and the importance of maintaining an online presence, almost all brokers offering online Installment loans with no credit check have streamlined online applications by providing step-by-step instructions. This saves borrowers the effort and time of visiting a physical brand or office. Before applying for the loan, the applicant must keep all relevant documents handy.

At Heart Paydays, individuals can apply for a loan by following 4 simple steps.

- Selecting the loan amount

Before applying for the loan one must always be sure of how much money they are requesting and for which purpose. As such individuals are already in quite a degree of financial stress, it is quite common to make further financial mistakes when accessing credit. Also, taking ut multiple loans isn’t advised and thus one should be clear about the loan amount from the start. Borrowers can request loans up to $5000 with Heart Paydays.

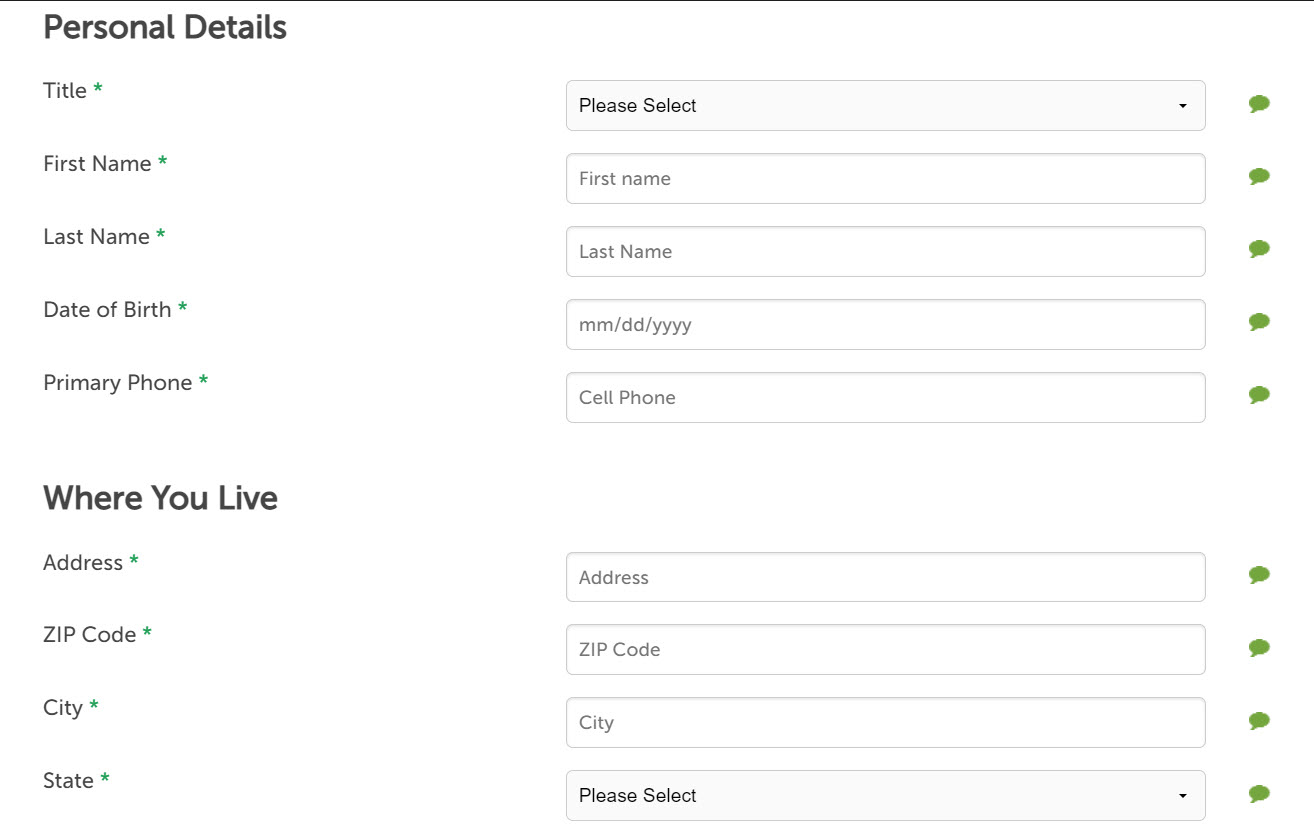

- Finishing up the loan application form

The application form is provided so that the borrower can provide some basic information about him/herself to the lender. The one at heartpaydays.com is one of the most streamlined and simple forms in the market. Individuals simply have to enter the desired loan amount along with their desired loan repayment plan.

- Waiting for the decision from lenders

Heartpaydays.com usually requires some time after the applicant has submitted his/her application for online loans with no credit check. As per their terms and conditions, heartpaydays.com does not carry out any credit checks on its applicants as its main job is to connect them to reliable lenders. At this stage, the applicants might be subject to credit checks from the lenders who might use external credit reference agencies or scoring services to evaluate a particular application. Heartpaydays.com may also pass the applicant’s personal information to prospective lenders as stated in their privacy policy. This stage may involve credit and identity checking via third-party institutions.

- Loan approval

After the lenders have performed the required security checks, the applicant will receive a notification that their loan request has been approved. The time taken for the loan amount to reach the borrower’s account also depends on the policies of the broker and the bank used. Normally lenders under heartpaydays.com accept and credits the loan amount within one to five days.

How to find the best No Credit Check Installment Loans in the USA?

Small payday loans online with no credit check can easily be found online. A simple search query like “how to get a loan with no credit” will yield a multitude of online lenders. However, the problem is that the market is filled with unscrupulous lenders trying to lure unsuspecting individuals. Being under the terms and conditions of a dishonest lender can lead one to further financial ruin.

Many individuals prefer long-term installment loans with no credit check from direct lenders because of a prior relationship with the lender. However, it always makes more sense for borrowers to look for brokers rather than individual lenders. Here are some of the reasons why.

- Accessibility and success rate

Signing up with a broker increases the chances of getting a bad credit loan. There are some brokers that work with lenders who do not offer services individually. A broker such as heartpaydays.com can provide a comprehensive medium from which one can shop for loans from several providers.

- Avoiding leg work

Most brokers such as heartpaydays.com work with an ever-expanding network of lenders, some of whom which the borrower wouldn’t have known of if he/she went shopping online. Brokers can also prevent borrowers from being erroneous and hidden fees by dishonest lenders.

- Terms and conditions

Brokers that work with several lenders increase the chances of getting favorable terms and conditions for a bad credit loan. Brokers such as heartpaydays.com enjoy large success rates when it comes to granting loans. Individual applications are rarely rejected by the lenders under its network.

Conclusion

There are predatory lenders out there and there are honest ones. It is up to the borrower to conduct due diligence before signing up with a lender. Monthly installment loans with no credit check from direct lenders and brokers are the only option left for individuals tackling a credit problem. Choosing a broker like heartpaydays.com increases one’s chances of getting a loan granted with favorable terms. The online portal is safe, smooth and allows access to credit within one to 5 days of applying.

FAQs

How can I apply with loan providers that will not perform a credit check?

To be absolutely sure that the credit lender does not perform any credit checks, one will have to go through their terms and conditions and privacy policy. Brokers themselves do not normally perform credit checks.

Individuals looking for bad credit loans cannot afford traditional credit checks as the requirements are pretty high. On the other hand, these bad credit lenders have a less rigid criterion that can help credit-challenged individuals get some financial relief.

How Much Money Can I Borrow?

The total amount of money that one can take out as a loan depends on the type of lender selected. Payday loans, bad credit installment loans, and other short-term loans are usually small in size, ranging from a few hundred to several thousands.

At heartpaydays.com, an applicant can borrow up o $5000 from their selection of different lenders who offer high-interest bad credit loans.

How Much Interest Will I Have to Pay on My Installment Loan?

The interest rate is represented by the APR or annual percentage rate. One can calculate this by multiplying the interest rate by the number of periods in a year. Contrary to popular perception, it is not an indication of how many times the rate is applied on the loan balance. APRs can vary on the type of lenders chosen, with installment loan lenders charging some of the highest interest rates in the industry. Some lenders also charge high APRs for late payment or for violating other terms of the agreement.

The APR tends to be higher than the normal interest rate, as it does not account for any other expense accrued by the bad credit loan lender. Heartpaydays.com offers loans from lenders with APRs ranging from 5.99% to 35.99%.

Can Applying for Multiple Loans affect My Credit Score?

An individual’s financial relationships and other wealth of information are stored in consumer credit reports. This contains creditor relationships such as any mortgages, auto loans, credit cards, and of course, installment loans. In fact, lenders sometimes look at these credit reports before granting a loan.

Applying for bad credit loans from multiple lenders results in multiple credit inquiries which may have disastrous consequences on the credit score. Lenders look down upon multiple inquiries as they consider it as a sign of high credit and immediately reject the application. So it’s best to find out what one’s options are before going ahead and directly applying for a loan from different lenders.

This is why it is ideal that one go to a lending broker for an installment loan for bad credit. These brokers work with different lenders and are committed to finding the right fit for their clients. Not only does it save the individual a lot of hassle, but his/her credit score also does not get affected by inquiries.

Where can I get an installment loan with no credit check?

One can get installment loans with no credit check from a variety of brokers and lenders both online and offline. The best thing is to search the web for the best rates and compare them side by side. However, this can take a lot of time and resources that one cannot afford.

Luckily there are brokers like Heartpaydays.com, which provide lenders with loans that do not require credit checks. This gives the opportunity for many credit-challenged households to get some financial relief.

Can I Have Multiple Installment Loans?

Technically it is possible to take out more than one personal loan for bad credit with some lenders. Alternatively, borrowers can also apply for multiple personal loans across different bad credit lenders. However, due to the legal constraints, borrowers are more than likely to be blocked from getting multiple loans by the lender itself. They typically limit the number of loans or the loan amount per loan.

While there are no federal regulations that stop anyone from taking out multiple installment loans, this practice is generally discouraged. This is due to the high interest rates associated with these types of loans, which can become a burden when one is already struggling with paying the bills. This is why they are always advised to evaluate their requirements before they apply for the loan.

How Do I Know if a Lender is Legitimate or a Scam?

Before taking out a loan from any online lender, the first step is to check if it’s legitimate. This can be done by inspecting reviews on eternal websites. Any loan provider in the US has to be registered with the United States federal or state laws. The borrower must also review the fees listed on the offer, as some lenders charge origination fees, prepayment penalties, and late fees.

To be absolutely sure that one doesn’t fall into a debt trap with unscrupulous lenders, one can go for Heartpaydays.com which has a list of reliable lenders under its network.

How can I apply for a Guaranteed Unsecured Personal Loans No Credit Check loan near me?

The best way to shop for installment loans for bad credit is to search online. There are numerous brokers and lenders that provide bad credit installment loans at high interest. However, not all of them practice ethical business operations which can lead many unsuspecting clients to financial doom.

This is why it’s best for a newcomer to connect to brokers that can be the intermediary between them and the market. A broker like heartpaydays.com can connect borrowers to different lenders with APRs ranging from less than 4% to more than 30%.

How Can I Apply For Bad Credit Loans?

If an individual is in a financial position where any delay in the payment of bills can cause him/her further, irreversible financial harm, then bad credit loans are right for him/her. There are numerous lenders that offer bad credit loans with high interest but reliable sources. But making multiple inquiries is time-consuming and not a practical solution.

This is why it is advised to connect to a broker such as heartpaydays.com which can cover a large area of lenders with different terms and conditions. According to their privacy policy, the broker itself does not conduct any credit checks and simply works to match the best lender with the most appropriate applicant.

Is Bad Credit Personal Loans Guaranteed Approval No Credit Check Right For Me?

Bad credit loans are simply a short financial fix for consumers who have an urgent need for money but have a bad credit score. While it’s not a perfect fix when it comes to most lenders, this may be the only choice left for credit-challenged individuals. These lenders are like banks without offices and offer these loans for purposes such as debt consolidation. The most attractive things about these loans are that they are very fast, both in their processing and the amount finally reaching the borrower.

This type of loan should only be considered after an individual has exhausted all other avenues of accessing traditional credit. This is mainly due to the harsh credit measuring methodologies employed by many banks and financial institutions. Brokers such as heartpaydays.com work with lenders that have very low requirements when it comes to creditworthiness. However, the high interest involved may put a strain on one’s finances if he/she doesn’t plan out his/her repayment schedule.