Federal employee or not, financial struggles can strike at any time – and when they do, they can really shake you up! If you don’t already have access to installment loans for federal employees, you may find yourself scrambling for financial solutions. And often that kind of scrambling turns up poor options or nothing at all. One of the go-to solutions for many in the same boat as you is the various online installment loans for federal employees. These loans are designed for people with a federal background, and they cater to your specific needs and financial situations.

This overview provides insight into the installment loans for government employees available through the Heart Paydays loan-finder service. You will learn what installment loans for federal employees are, how they work, the types available for you to apply for, the eligibility criteria, and four simple steps to getting online installment loans for federal employees. We also cover several FAQ’s to ensure you can make an informed decision when you start your application.

What Are Installment Loans For Federal Employees & How Do They Work?

Installment loans for federal employees are typically unsecured loans. As a federal employee, there’s no requirement to put up collateral to secure your loan as long as you’re in a financial position to pay the loan off and the lender considers you credit-worthy after doing their required checks. Unsecured installment loans for federal employees are sometimes called allotment loans in the industry. They sometimes allow federal employees to borrow money and repay the loan in affordable installments through their payroll system. Your loan installment amount is automatically deducted from your paycheck before it is paid to you and then applied to your loan. This is done via direct debit set in place by the lender.

Online installment loans through Heartpaydays.com follow a straightforward loan model. Select the amount you wish to loan and how long you want to repay it over, and the automated system will present you with information if one of the lenders on the Heart Paydays panel can assist. After that, there is a simple application process where you fill out an online form with your particulars and will finalize the loan with the lender or broker offering the loan.

Types Of Installment Loans For Federal Employees Online

There are several types of installment loans for government employees from which to choose. Your best bet is to apply for these loans through the Heartpaydays.com network. Here’s a look at some of them:

Installment Loans For Federal Employees With Bad Credit

Bad credit can be a hack. It can follow you around and haunt your credit profile for years – that’s just a fact of life. Another fact of life is that nothing stays the same forever, and you could very well have turned your financial situation around by now. If you can prove it with at least three months’ pay stubs, a list of expenses that don’t over-indebt you, and a monthly income of $1000 or more, you could still be eligible for a loan with bad credit with specific lenders. Installment loans for federal employees with bad credit via the Heart Paydays website typically range from $100 to $5000, and the good news is that you can get between 3 and 24 months to pay. The installments are then worked out on the total loan amount plus interest split over the chosen months. The final installment amount will depend on how much you loan and, of course, the interest rate you get. Most lenders, through Heartpaydays.com, offer 5.99% to 35.99% interest – and most are negotiable on interest too.

Online Installment Loans For Federal Employees

Who says loans are about long queues or tedious visits to the bank? Now you can secure online installment loans for federal employees without leaving the comfort of your home or office. Applying for a federal employee loan is simpler than you think. You simply need access to the internet and a device (such as a laptop, desktop computer, iPad, or mobile phone). The online application takes just a few moments, and if your loan is approved, it is typically paid out on the same day or by the next business day. In addition, online installment loans for federal employees offer total privacy and discretion.

Same Day Installment Loans For Federal Employees

Waiting around for cash is tough. In fact, it can be downright frustrating. You may miss out on a deal, find yourself in a tricky situation, or be unable to get yourself or a loved one the care needed because you’re waiting for loan funds to pay out! When you apply for installment loans for federal employees via the Heart Paydays website, you can rest assured that the lenders on the panel have a reputation for quick turnarounds on loans. This means that they disburse funds reasonably quickly. Some lenders have a reputation for organizing 60-minute (from approval) payouts, whereas others ensure the funds hit their client’s bank accounts by the next business day.

Unsecured Installment Loans For Federal Employees

While secured loans are easier to get approved for, they come with inconveniences. First, you have to have something of value that you can use for collateral. Occasionally, acceptable collateral is a car, a home, or jewelry. And if you run into problems with your payments, you could lose ownership of the asset. This is why unsecured installment loans for federal employees are an attractive option. With unsecured installment loans for federal employees, there’s no requirement for collateral or a co-signatory. Keep in mind that this increases the risk for the lender, ultimately resulting in a higher interest rate for the borrower. The unsecured installment loans for federal employees range from $100 to $5000, with interest rates ranging from 5.99% to 35.99%.

Features Of Online Installment Loans For Federal Employees

If you’re looking for installment loans for federal employees, you will find that they share the same features as various other instant cash loans online. Some of these features include:

Online Application That Takes Just A Few Minutes

You will find several options for online installment loans for federal employees on the Heartpaydays.com site. One of the biggest perks of using this loan-finder service is that the entire process is handled online. You never have to make a trip to a storefront or have an in-person meeting at all. All you have to do is complete the online application form using your internet connected computer or mobile phone. Once you’ve filled out the digital form and hit the “submit” button, you only have to wait 2 minutes. That’s all it takes to get feedback on your loan application. If you’re happy with what the lenders that can help you have on offer, you will be transferred to finalize the deal with the lender or broker offering the deal.

Quick Disbursements Of Cash

There’s no waiting around for cash when getting approved for installment loans for government employees via Heart Paydays. Instead, the lenders on the panel have a reputation for getting things done speedily. While all boxes are checked, and the entire process is above board, the lenders that work alongside Heartpaydays.com often pay out loans within one hour from the loan being approved. You can generally expect payments to be made on the same day or by the next business day – and that’s on all loans, not just the online installment loans for federal employees.

A Decent Range Of APRs

APRs can be a scary thing. Often, especially in the case of installment loans for federal employees with bad credit, when a loan is approved, the borrower holds their breath when checking the details. That’s because such loans often come with hefty interest rates attached. And when you’re not using a loan-finder like Heart Paydays, you could find yourself paying up to (or even more than) 400% interest! At Heartpaydays.com, there’s no need to hold your breath too much! The interest rates charged are pretty standard, ranging from 5.99% to 35.99%. And, of course, as you may well know, the loans industry is a competitive one, and often lenders are willing to negotiate lower interest rates in a bid to remain competitive.

Examples of Installment Loans for Federal Employees Via Heartpaydays.com

It’s important to have a bit of understanding of how the loans market works before applying for installment loans for federal employees. Here’s a quick look at some of the loans on offer:

| Lender | APR | Loan Amount | Min Credit Score | Funding Time |

| LendUp | 30% – 180% | $100 – $500 | None | 24 hours |

| Avant | 9.95% to 35.99% | $2000 to $35000 | 580 | 24 hours |

These are just examples and are subject to change.

The Advantages And Disadvantages Of Installment Loans For Government Employees

When applying for federal employee installment loans, there are several factors that are at play. Having a better understanding of the pros and cons of such a loan will further equip you to make an educated decision. Here’s what to expect:

Advantages of Installment Loans For Federal Employees

60-Minute Payout

Breathe a sigh of relief when your loan is approved because most lenders on the Heart Paydays panel do their best to pay out loans within just 60 minutes of approval. If they are unable to do that, you may find yourself waiting for just 24 hours – which is entirely doable when you consider that some bank loans take days to set in place.

Absolute Discretion

You probably wouldn’t update your social media statuses with “I just got a bad credit loan” or “I am applying for a payday loan online,” would you? That’s because most of us aren’t comfortable with sharing the finer details of our finances with the outside world. Getting online installment loans for federal employees plays into that quite nicely because they are entirely discreet. The lenders won’t share your information with other parties, and you can take out a loan without anyone in your life ever having to know about it. Your finances are your business when using the Heartpaydays.com loan-finder service.

Reasonable Eligibility Criteria

Some banks and financial institutions have strict eligibility criteria, making it exceptionally difficult to qualify for a loan. When trying to secure installment loans for federal employees using the free loan-finder service offered by Heart Paydays, you will notice that the eligibility criteria are very reasonable. You must earn at least $1000 per month. You must be a resident or citizen of the USA and prove that you can afford the installments of the loan (please read on to find a full list of eligibility criteria below).

Disadvantages Of Online Installment Loans For Federal Employees

Expensive

Unfortunately, lenders offering same day loans online cannot match the low costs of banks. But that’s not all that bad when you consider the convenience and just how quickly you can get online installment loans for federal employees secured when using a loan-finder service such as Heart Paydays. Interest rates range from 5.99% to 35.99%.

Are You Eligible For Installment Loans For Government Employees?

While there’s no shortage of lenders offering installment loans for federal employees, the big question is whether or not you’re eligible to get a loan. At Heart Paydays, most lenders have similar qualifying requirements, and these are as follows:

- Minimum age limit of 18 years

- Only US citizens and legal residents may apply – you will need proof of address

- Applicants must provide their Social Security Number and a valid form of ID

- Earnings each month must be $1000 or more to apply

- Applicants must have the supporting documentation on hand

- An active bank account and mobile number in the US are required

Just 4 Easy Steps To Apply For Installment Loans for Government Employees

You will find that the application process of installment loans for federal employees via the Heart Paydays site is quicker and easier than you think. In fact, there are only four steps you have to take to get the loan in place. Follow these simple steps to apply for federal employee loans online:

Step 1: Choose How Much You Need To Loan

Take some time to figure out how much you genuinely need. Don’t take a stab at applying for a large amount because you may find that when the lender analyses your current financial situation, they find that you’re not eligible for the loan because it’s ill-affordable to you. Loans via Heart Paydays range up to $5000 but only apply for what you need. The more you borrow, the more interest you will pay – always keep that in mind. Interest ranges from 5.99% to 35.99%.

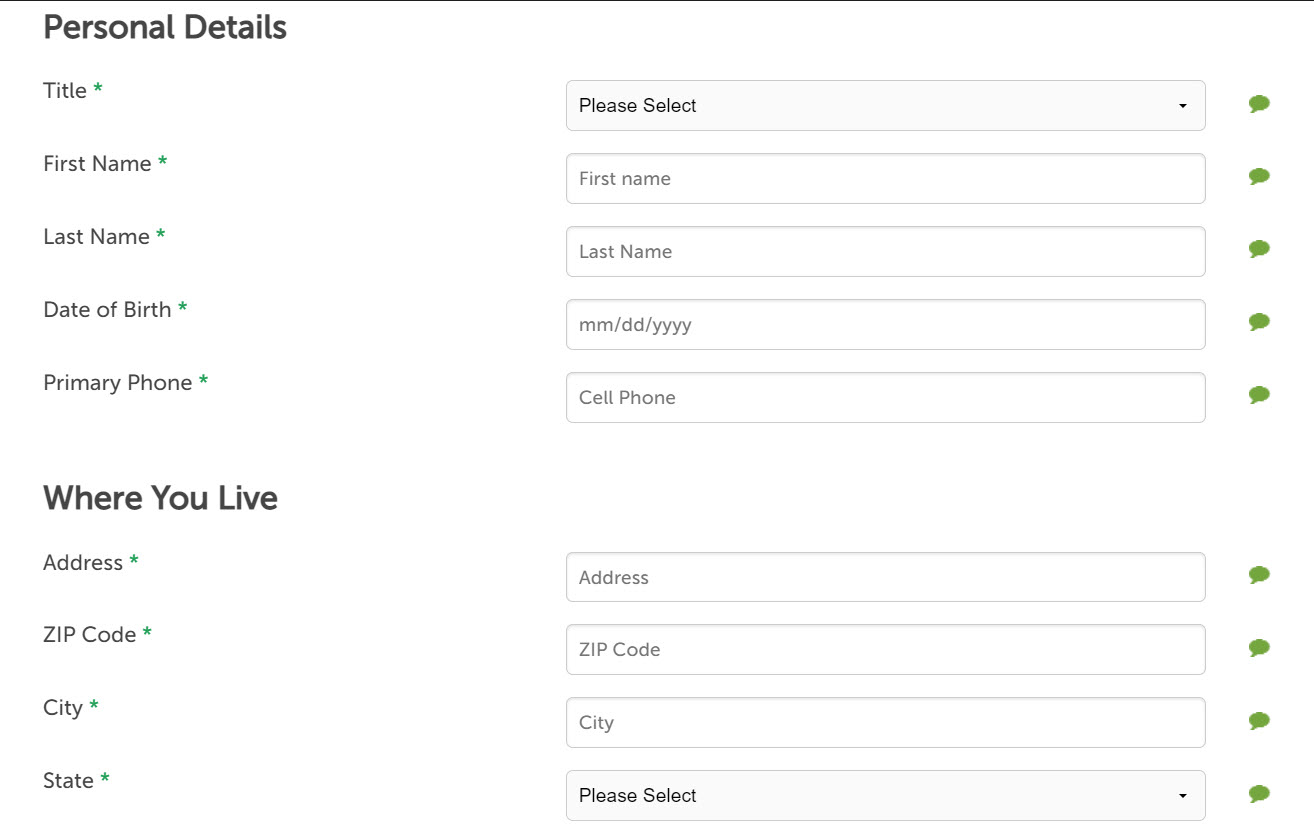

Step 2: Complete The Online Application

Once the system has generated a possible installment for you, you may want to take the next step and actually apply for one of the installment loans for federal employees that are available. Simply click on “Apply,” which is found on the top right-hand side of your screen. Then, get to work providing all your information. This will range from your full name and surname all the way to what your monthly expenses are. Be as thorough and accurate as possible, as the information you provide will affect the outcome of your loan application.

Step 3: Wait Two Minutes For An Outcome

It takes just two minutes, or the same amount of time it takes to make a cup of coffee, to get an outcome for your loan application. Of course, this is a pre-approval and subject to further checks by the lender. But in just two minutes, you can know if you’re able to get installment loans for federal employees. If your supporting documentation is all in order and your information checks out, the lender can finalize the loan with you on the spot and get the money into your account as soon as possible. In the event that no lender is able to assist, you will also be notified, and alternative financial aid will be recommended. This includes the likes of debt consolidation and credit repair.

Step 4: Sign The Loan Deal – Get Your Cash

If all is a go-ahead from both sides (you and the lender), you will be provided with a copy of a loan agreement to sign. The lender can only pay out the cash if this agreement is signed. It is essential that you read through the entire contract and ask questions if anything is incorrect or unclear. Once you’ve signed the agreement, the lender pays out the cash – simple as that. This takes around one hour in many instances, but that cannot be guaranteed. Expect to see the money in your account by the next business day.

And that’s how you apply for installment loans for federal employees online using the Heart Paydays loan-finder service!

FAQ’s

What Is The Easiest Loan To Get Approved For As A Federal Employee?

The good news is that you can get a payday loan, same day loan, and unsecured installment loans for federal employees. You don’t even have to apply at each of the lenders yourself. Simply use the Heart Paydays loan-finder service online. Apply once, and you’ll be presented with ideal options for your financial situation.

Do Federal Employees Have To Pay Interest On Loans?

Unless you have something worked out with the government where you have access to interest-free funds, you will have to pay interest on your loan. At Heart Paydays, the interest rate is kept reasonable. Lenders typically charge 5.99% to 35.99%.

How Do Installment Loans For Government Employees Work?

Government employees can take out installment loans via the Heart Paydays portal. Select the loan amount, make an application and ensure you provide accurate information. These loans are based on paying back the loan amount plus interest (5.99% to 35.99%) over a set period. The installments are fixed so there are no nasty surprises. And the repayments are made easy with month debits from your bank account.

Are Installment Loans For Federal Employees Secured Or Unsecured?

In general, most installment loans are unsecured. The loans that you can get through Heartpaydays.com are also unsecured. That said, there are some installment loans that can be set in place that require collateral – and in such a case, the loan is secured.

What Is The Minimum Amount A Federal Employee Must Earn To Apply For A Loan At Heart Paydays?

Most lenders have similar requirements when it comes to earning minimums with installment loans applications. If you earn a minimum of $1000 per month and have been employed for longer than 3 months, most lenders will consider you eligible for a loan.

What Qualifies As An Installment Loan?

Installment loans are types of loans where the borrower gets a set amount of money as a lump sum. They must then repay the amount over a fixed number of payments. These fixed payments are called installments.

Do Online Installment Loans For Federal Employees Require A Credit Check?

Lenders are required to carry out a credit check. So, while Heart Paydays won’t carry out a credit check on you, the lenders offering you loan packages might.

What Credit Score Do I Need To Get Installment Loans For Federal Employees?

Most lenders require an individual to have a credit score of at least 580. That said, you will need a higher credit score if you wish to get a personal installment loan without an origination fee attached and with a very low APR. There are some lenders that loan money to borrowers with lower credit scores, though.

How Many Installment Loans Can A Federal Employee Have At Once?

Federal employees can only take out one installment loan at a time. Only once your installment loan has been paid off can you apply for the next loan via Heart Paydays. Taking out several loans at once can only lead to over-indebtedness. If you cannot get a loan for the amount you want, it is certainly because the lender has crunched the numbers and they have determined that the requested amount is ill-affordable when considering your current financial situation.