In some cases, the significantly less risky method of acquiring a loan despite having a bad or no credit score is known as an installment loan or payday loan. It could be seen as a temporary financial fix for individuals who need to borrow some money even though their credit score is too low or when they have a poor credit history. All that you need to be careful about is ensure that the installment loan provider is a trustworthy one. Applying for guaranteed installment loans for bad credit is an extremely easy process.

What are Guaranteed Installment Loans & How Do They Work?

As the name suggests, installment loans come with an option to be paid in installment which makes them less risky and more affordable than other alternatives out there in the market. A guaranteed installment loan frees your mind from the constant anxiety associated with loan repayments because borrowers can decide and manage to pay smaller payments over time.

It is better than having to pay the full amount including interest at once. Types of installment loans include auto loans, student loans, mortgages, and personal loans. When a person has a low credit score and/or bad credit history needs to borrow, they apply for guaranteed installment loans also called bad credit loans.

These do not require a thorough credit performance check. Ideally, people looking for installment loans for bad credit would find it at a below 36% APR including other fees.

Guaranteed installment loans for bad credit require collateral (anything valuable) from the borrowers. People who qualify for installment loans have to make sure that they can repay the loan within the fixed tenure or else they could lose their possession. Some lenders do not disregard people who have very poor credit scores but they consider available income and current debt of the borrower to approve their loan request when they need money most.

Examples of Guaranteed Installment Loans:

Bad credit guaranteed installment loans with cosigner

An approach to get a low interest rate on your installment loans is to get a cosigner. You could try getting a cosigner instead who has a good credit score and favorable credit history for your bad credit guaranteed installment loan.

All you have to do is find and approach a qualified co-signer so that the lender would set the loan terms based on the individual with a better credit score.

Bad credit guaranteed installment loans direct lenders

Direct lenders who often approve bad credit guaranteed installment loans are also known as Peer-to-Peer lending. In P2P lending, an individual with a bad credit score can acquire an installment loan directly from another individual or a group than from an institution.

To request a loan from direct lenders, borrowers post a listing online on P2P websites mentioning the amount needed and their reasons for borrowing.

Guaranteed Installment Loans in the USA

Based on which state of USA you reside in, the rules, procedures, and restrictions related to guaranteed installment loans are different.

Guaranteed Installment Loans For Bad Credit Direct Lenders California

40% of the population in California find themselves struggling to make the ends meet. Within California, there is a huge number of direct lenders that provide guaranteed installment loans no credit checks in a few simple steps. Most residents take out an installment loan when their savings seem insufficient to support their daily lives.

To take a safe and practical approach for installment loans for bad credit in California, you must have an understanding of the amount you require and the time taken for repayment.

Guaranteed Installment Loans For Bad Credit In Pennsylvania

People of Pennsylvania are way ahead in terms of installment loans since they opt for instant online loans which can be repaid in installments. This financial option is famous among Pennsylvanians with poor credit scores.

Some of these providers do not even hold the personal belongings of borrowers as collateral but they charge a lot as fee and interest rates.

Guaranteed Installment Loans For Bad Credit Direct Lenders Only Ohio

Ohio is home to many industry leaders and is ranked third in terms of manufacturing employment across the nation. Despite this fact, the economic situation of Ohio residents is not at all satisfactory. Many of these people have a hard time dealing with their finances and require money to stabilize.

People are used to taking installment loans for bad credit and direct lenders are their preferable choice at times because it’s easy.

Guaranteed Installment Loans For Bad Credit Direct Lenders Virginia

The law in Virginia allows one to opt for an installment loan valued anywhere between $1000 and $5000 within a pre-determined schedule for repayment that does not often exceed 36 months. People in Virginia who have a low FICO score choose a direct lender to get a bad credit personal loan if they can repay the borrowed money in installments.

Installment loans are not legal across every jurisdiction in Virginia so make sure that you do some research before approaching a direct lender.

Features of Guaranteed Installment Loans

Being the most popular loan options out there, people choose guaranteed installment loans due to the following features;

- Flexible terms

Installment loans are perhaps one of the most flexible loan options out there for individuals with bad credit scores. Its flexibility depends on the online lender you choose to borrow money from.

- Loan amount

The amount available for eligible borrowers to opt for through direct lending is $500 to $1000 at a time. This range is also comparatively easy to repay including the interests and other fees if applicable.

- Fees

Getting an installment loan online through direct lenders is a great idea because no prepayment fees are involved. Apart from penalties, people save a lot on fees via installment loans.

Charges and Penalties for Guaranteed Installment Loans

The restrictions surrounding bad credit loans are put in place to protect consumers from risky and often predatory lending.

- Interest

For each installment that borrowers pay as repayment, interest is charged which is, in fact, a portion of the principal amount borrowed. These interest rates are less than their traditional alternatives and hardly exceed 36% APR.

- Transfer fees

The range of transfer fees is usually between 3% and 5% at all times but when you are dealing with installment loans you can expect different transfer fees.

- Penalties

If you have the means to repay your installments of a loan as per schedule then you should not be worried about penalties. Penalties ensure that borrowers always repay by the end of the allotted time.

Eligibility Criteria for the Guaranteed Installment Loans in the USA

Guaranteed installment loans in the USA are an easy way to borrow money without thinking about requirements that are impossible to fulfill for normal people. Lenders find out whether you are eligible ideally by asking for your name, age, social security number, and other basic details.

In case you choose an online broker like Heart Paydays then you must have the following;

- A valid mobile phone connection and email address

- A US bank account is crucial

- Age of 18 or above

How to Apply Loans for Guaranteed Installment Loans in Quick Steps

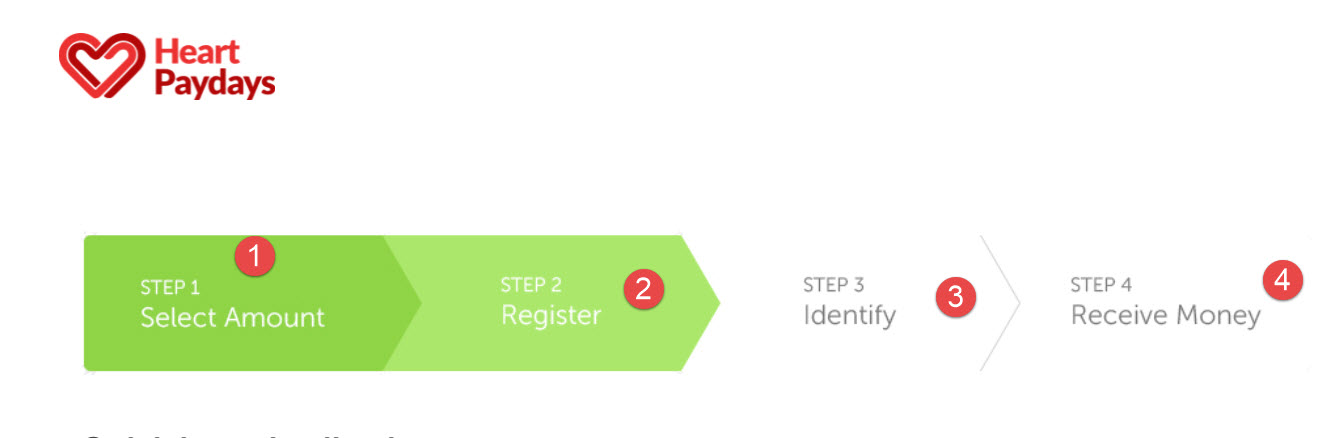

Applying for an installment loan from an online broker like Heartpayday.com is quite easy. Below are the easy steps to apply for guaranteed installment loans;

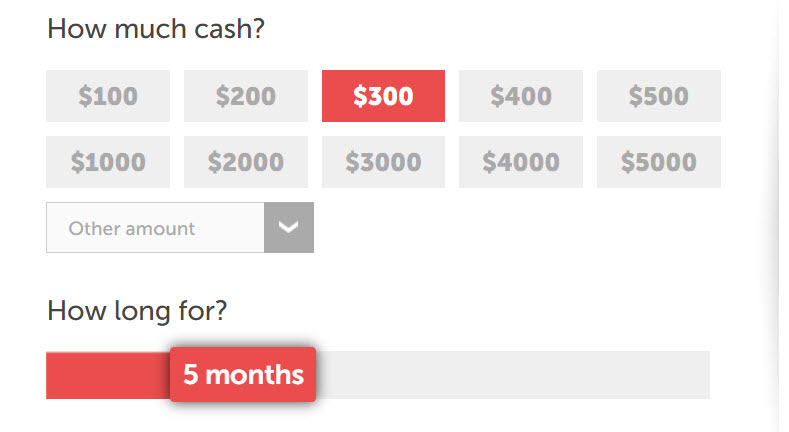

Step 1: Choose loan amount

Firstly, the borrower chooses the loan amount as per their requirement. Deciding this amount is of utmost importance which is why one must take as much time as they need to figure out their requirement. Heartpaydays.com allows borrowing up to $5000 as the loan amount.

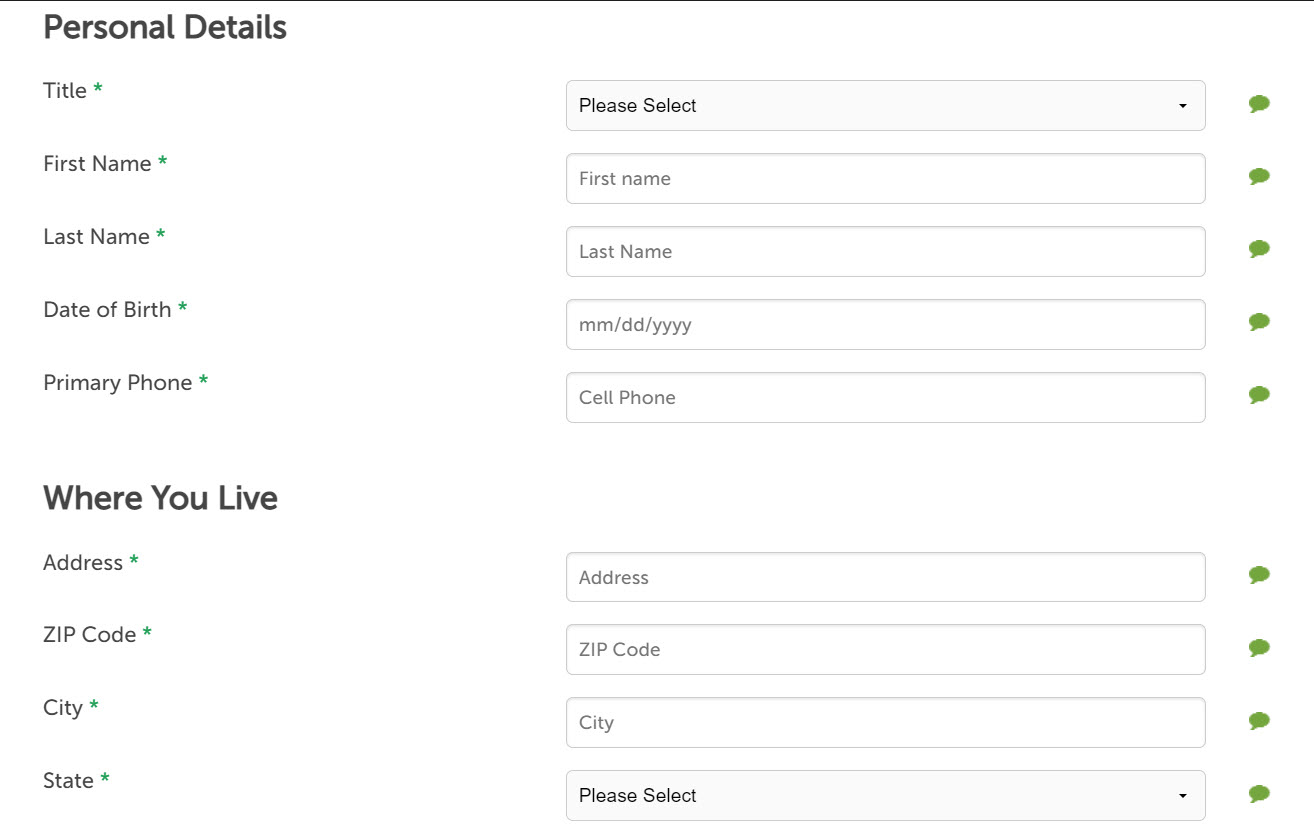

Step 2: Complete the application form

Next, you must fill up and submit an application form. On heartpaydays.com, you will find a detailed and comprehensive application form where you put the loan amount desired and accept the terms to proceed.

Step 3: Wait for a decision

After applying, you need to wait until the lender decides whether to accept or reject the said application. It might take a few days for heartpaydays.com to pass your financial details to prospective lenders who verify whether the applicant can repay a loan on schedule or not.

Step 4: Get your loan

As soon as the lender responds positively, applicants get a notification that says that their loan request has been completed.

How to find the best-Guaranteed Installment Loans rates in the USA?

There is no shortage of installment loan providers that tend to people having bad credit. The terms, features, and process is more or less similar and transparent no matter which online provider you choose. To avoid being confused and wasting a lot of time waiting for loan approval, one could opt for Heart Paydays.

If you are looking for an approved loan then applying to Heart Paydays can increase your chances exponentially. In this case, after sending an application, borrowers do not have to wait for several days for the approval to come through. Once matching a borrower’s request with a suitable lender is done, the borrower receives a timely notification about getting the best loan terms saving both time and effort.

With heartpaydays.com, a borrower in need of guaranteed installment loans for bad credit can choose from several loan programs by comparing closing costs, interest rates, and details of the lender to find their perfect match.

Conclusion

Heart Paydays does not deny people with bad credit and approves their installment loans quickly. Many types of loan plans are equally popular in the USA so that people can get guaranteed installment loans for bad credit and thus acquire the financial support they need. The best part is that borrowers who choose Heart Paydays get access to many products of varying price ranges on its user-friendly platform.

FAQs

Why Choose Guaranteed Installment Loans?

In case you have a bad credit score, you would be denied a loan from several banks and financial institutions. That is why guaranteed installment loans are the best and secure way to borrow money.

Where can I get a Guaranteed installment loan with bad credit?

There are various portals from where one could get a guaranteed installment loan even with bad credit. Heartpaydays.com is one such platform where a person with bad credit can get an installment loan without any worries.

Can I Have Multiple Guaranteed Installment Loans?

Within heartpaydays.com, you can take out multiple installment loans as per your requirement without any worries but only after ensuring that you can afford to repay them as well.

How Do I Know if a Lender is Legitimate or a Scam?

Unfortunately in this market, there are lots of scam loan providers in addition to legitimate ones. You can spot a scam company by carefully checking their contact information like email, phone number, physical address, and registration details.

Where Can I Get A Guaranteed Bad Credit Loan in the US?

In the US, many guaranteed bad credit loan providers legally help out a borrower. Heartpaydays.com is a great place where one can apply for a bad credit loan by following few simple steps.

How can I apply for Guaranteed installment loans for bad credit near me?

To apply properly for guaranteed installment loans for bad credit, you need to choose an online lender first of all. Once you have chosen, you can fill and submit your loan application and wait for its approval.

How Can I Apply For Bad Credit Loans?

Applying for bad credit loans is simple and less time-consuming because all you have to do is share your personal information, fill and submit an application mentioning the loan amount then wait for a positive response.

Is A Bad Credit Loan Right For Me?

A bad credit loan is the best and sometimes the only way to borrow money for individuals who have a poor credit score and have been denied financial help from everywhere else.

How do installment loans affect your credit?

Taking an installment loan does not hurt your credit history and score if you manage to repay on time. It could even benefit your credit history if a borrower makes on-time payments on their installment loans.