It is becoming increasingly important for both lenders and credit issuers alike to discover new customer segments, make smarter business decisions, and expand their business in today’s rapidly evolving alternative credit data marketplace. While the majority of their applicants are honest individuals who simply find themselves in a bad financial position, a lot of them also try to defraud the lender. This is one of the reasons why non-conventional brokers and lenders leverage Teletrack products to protect their business from the possibility of major defaulting.

Founded in 1989, the primary business of Teletrack is to track consumer credit history on behalf of lenders. While many bad credit lenders use Teletrack technology for credit assessments, there are some which offer no Teletrack installment loans with guaranteed approval.

What is Guaranteed Installment Loans & How Do They Work?

Guaranteed Installment Loans for bad credit are specifically designed financial products offered by online lenders and brokers for credit-challenged individuals who are struggling to access credit from traditional sources such as banks and other financial institutions. In the US, a FICO credit score of less than 580 is considered bad. Individuals with such credit scores or worse may experience immense difficulties when applying for lines of credit as they are turned down by the majority of traditional lenders.

Guaranteed Installment Loans for Poor Credit is one of the fastest-growing forms of consumer lending in the country. Most of these loans are provided by numerous lenders or brokers without any need for collateral. However, because of this, lenders charge higher interest rates compared to traditional loans, something which the borrower has to keep in mind.

When a borrower applies for an installment loan for bad credit, he/she must first choose the relevant loan amount and the terms of the loan. Installment loans usually require borrowers to pay back the loan following a specific payment schedule that is agreed upon by both parties. Some lenders even allow the borrower to pay back the loan before schedule.

Individuals can apply for guaranteed installment loans for Bad Credit from direct lenders if they believe that they are receiving favorable terms and conditions. Alternatively, they can apply for an installment loan with a broker such as heartpaydays.com. Heartpaydays.com works with a network of different lending brokers which increases the chances of the applicant’s loan being approved.

Examples of Guaranteed Installment Loans

To better understand the concept of guaranteed installment loans for bad credit, let us take a look at some of the different forms that are available in the market.

Guaranteed installment loans for no credit check

Individuals struggling with poor financial conditions may be in no position to apply for loans from traditional financial institutions. Their poor credit history or credit score prevents them from receiving a fair chance at accessing lines of credit.

Luckily there are several online lenders and brokers that offer guaranteed installment loans no credit checks. Most of these lenders and brokers charge higher interest rates to offset the risk they are taking.

Guaranteed installment loans for bad credit for poor

People who are poor or fall close or below the poverty line may need funds for emergencies for which they are not covered. This can include debt consolidation, healthcare emergencies, and even short-term expenses that cannot be delayed. Guaranteed installment loans from bad credit lenders may be the only option left for these individuals.

Financially challenged individuals can get thee loans easier and faster. However, they should be aware of the cycle of bad debt. Defaulting on an unmanageable payment with added interest payments can be a burden for any individual especially if he/she is stuck in a sticky financial situation. This is why borrowers should always outweigh the risks before applying for the loan.

Guaranteed installment loans for bad credit for business

Some entrepreneurs or business owners may suddenly find themselves disqualified from accessing lines of credit due to no fault of their own. Because of a sudden dip in their credit score, they may be unable to get further loans which may hamper his/her business operations.

Fortunately, these individuals can always take out installment loans for bad credit to remedy their financial position. Lenders also feel safer providing loans to an owner of a business compared to when they provide loans to low-credit individuals.

Guaranteed installment loans for government employees

Federal government employees in the United States can experience bad credit scores which can prevent them from applying for a loan with favorable terms and conditions. There are also some unscrupulous lenders that use their position to trap low-income government employees such as active service military personnel.

However, there are still several honest lenders and brokers which offer installment loans to federal government employees with poor credit records. Lenders take in less risk as the loan applicant is employed with the Federal government, guaranteeing an employment status.

Guaranteed installment loans no matter what

Some lenders advertise that they provide guaranteed installment loans no matter what the financial condition of the applicant is. While there are a few brokers and lenders that can indeed offer this, an overwhelming amount of lenders charge high-interest rates and other hidden fees that the applicant might not be aware of.

This is one of the reasons why borrowers must carefully go through and research the terms and conditions of each lender before applying with them.

Guaranteed installment loans for low income

Low-income individuals are often disqualified from applying for loans by banks and other traditional sources of credit. In a country like the United States where the expenses of essentials are higher than most other parts of the world, these individuals may find themselves struggling financially.

Lenders and brokers which offer guaranteed bad credit loans offer a solution for these individuals. These lenders simply require some basic information such as personal details, email, and phone numbers to begin the loan process.

Guaranteed installment loans for bad credit direct lenders only

Some borrowers prefer applying for loans directly with lenders for installment loans. Reasons for this include consistently favorable repayment terms or a past working relationship with the lender.

However, it is always advised to go for a broker when searching for installment loans for bad credit. This expands the number of options that borrower has which helps him/her to get favorable loan terms for an easy repayment process.

Features of Guaranteed Installment Loans

Guaranteed installment loans for bad credit are just like any other form of installment loan albeit with some minor differences. Looking at the features of bad credit installment loans will shed light on this subject.

- Borrowers can easily apply

Traditional banks and financial institutions often require individuals to provide a myriad of documents and certifications which may result in a lot of paperwork. These institutions also take a lot of time to conduct various credit checks on their applicant before finally deciding whether to grant the loan or not. On the other hand, online lenders who offer guaranteed loans do not have such rigid requirements. This allows credit-challenged individuals to apply and receive their loans within a short period of time.

- Chances of success are more

Compared to traditional lines of credit, lenders of bad credit loans do not judge an applicant by his/her credit score or credit history. The chances of getting a loan approved thereby increases by a lot. Guaranteed loans for bad credit are sometimes the only way for individuals to get access to credit in times of economic turmoil.

- Higher interest rates and fees

Because these lenders are taking the additional risk of offering unsecured loans to credit-challenged individuals, the interest rates associated with these loans are pretty high. The APR or annual percentage rate is the interest rate that applies to borrowers. For lenders providing installment loans to low-credit individuals, the APRs can typically range from 5% to 35% in some cases. Additionally, depending on the broker, applicants might also be subject to several fees which should be stated clearly in the loan’s terms and conditions.

- Clearly defined payment terms

Reliable brokers and lenders for bad credit installment loans usually provide a clear and simple installment plan which is easily understandable by the applicant. It usually contains straightforward payment plans where the loan amount along with interest has to be paid on a specific date. Many lenders also allow their borrowers to repay the loan before their scheduled time period. This is beneficial from the borrower’s point of view as he/she will be subject to less interest.

Charges and Penalties for Guaranteed Installment Loans

As mentioned before, lenders for bad credit installment loans usually charge a higher APR than traditional institutions. This is to offset the risk of providing loans to low-credit-worthy individuals. Borrowers should be well aware of the APR before taking out the loan as higher APR can put a strain on an individual’s repayment abilities. Individuals who apply at lending brokers such as heartpaydays.com can get access to lenders offering APR rates from 5.99% to 35.99%.

Other commonly associated fees include a loan origination fee, fees for application processing, and even late payment fees. Late payment fees can be a burden for credit-challenged individuals if they make one or more late payments to the lender.

Eligibility Criteria for the Guaranteed Installment Loans in the USA

Almost all United States citizens are eligible for receiving an installment loan for bad credit. This is because these loans have fewer requirements when it comes to the credit backgrounds of the individuals. Most brokers including heartpaydays.com make it very easy for almost anyone to apply for a loan. The broker has three main requirements, namely:

- The applicant has to be over 18 years of age.

- He/she must be a United States citizen and holder of a legitimate US bank account.

- The applicant must provide a valid email address and a working phone number.

Heartpaydays.com does not conduct any eligibility checks or credit checks on its own. However, borrowers may be subject to credit probes by some of the lenders under its networks before they are granted the loan.

How to Apply Loans for Guaranteed Installment Loans in Quick Steps

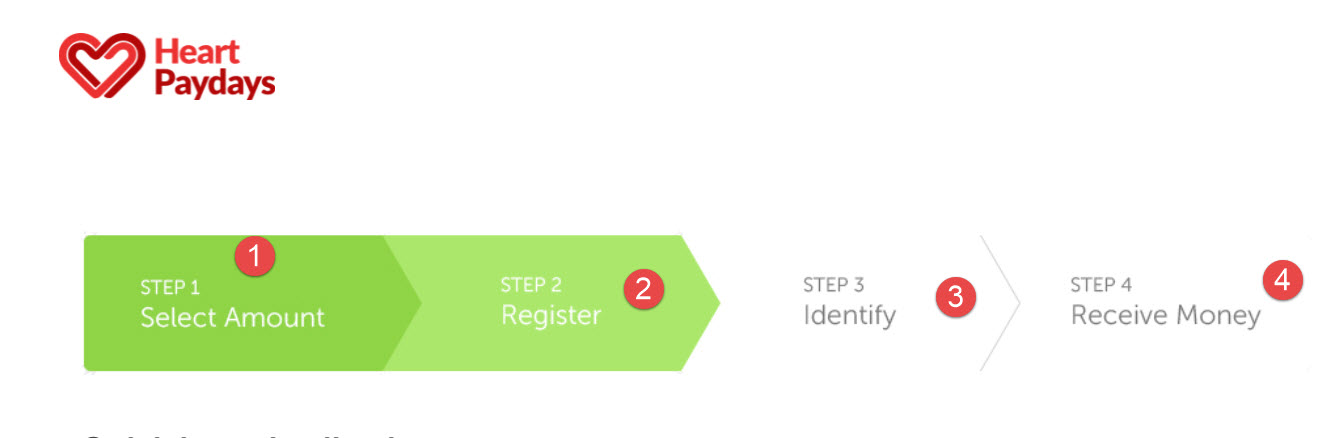

To make the registration and loan application streamlined, Heartpaydays.com has come up with a simple 4 step loan application process. This makes it easier for almost every individual irrespective of his/her background to apply and qualify for a loan at heartpaydays.com.

Requesting the loan amount

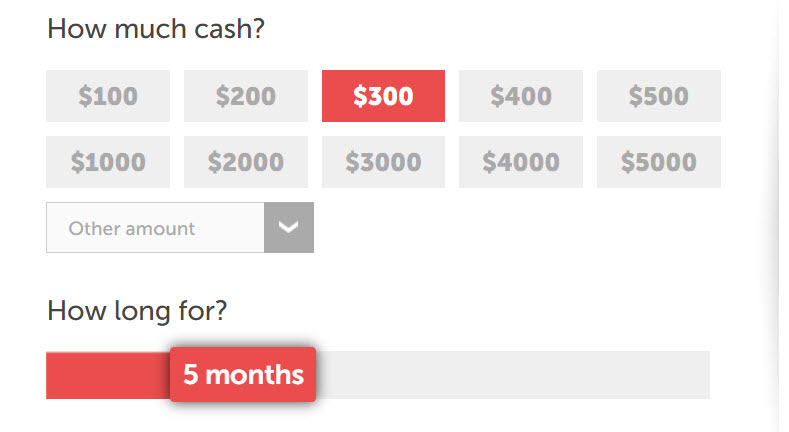

Heartpaydays.com allows any individual to request a loan amount up to $5000. Applicants should be absolutely sure of the amount they request and should ensure they have the means to pay back the loan on time.

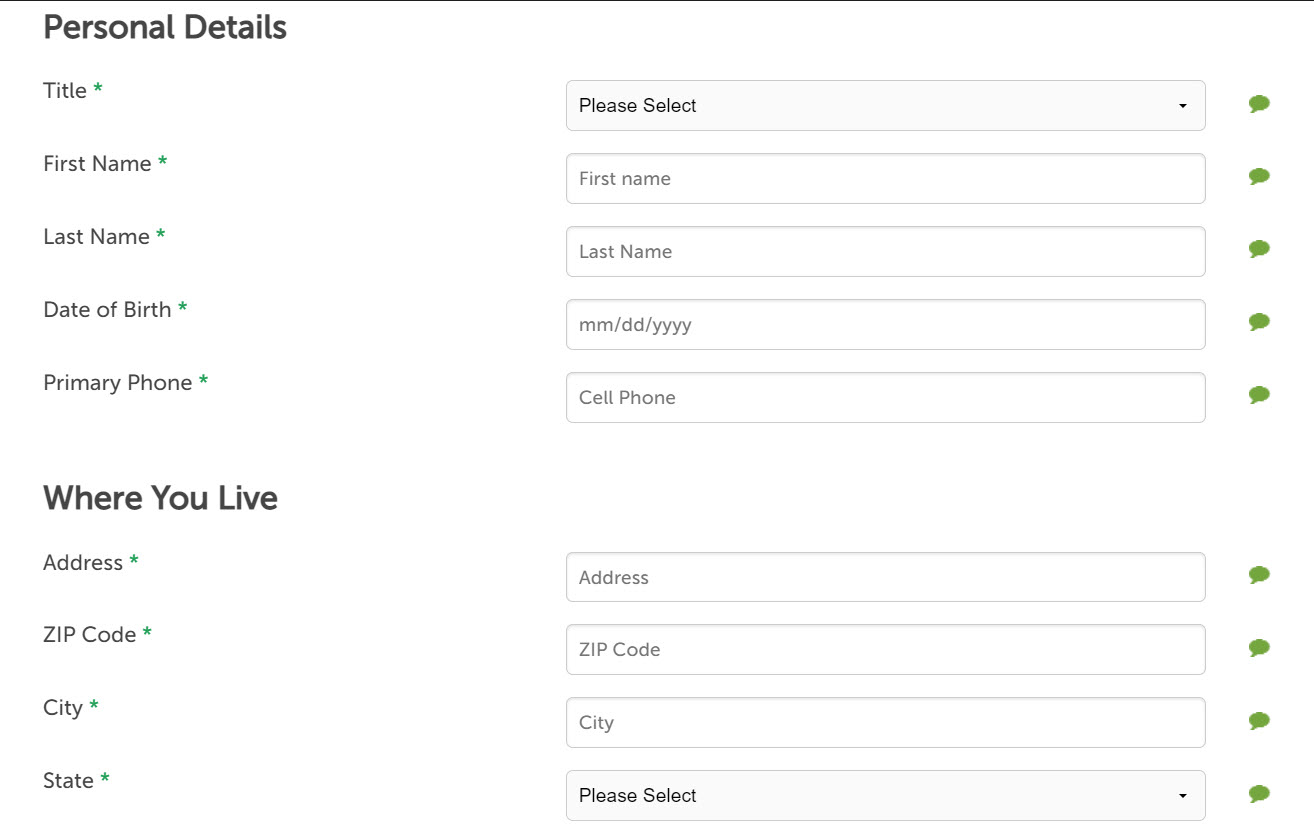

Filling in the loan application form

The form provided by Heartpaydays.com takes a matter of minutes to be filled in. The broker asks applicants to specify their loan amount and their preferred loan terms.

Waiting for approval from broker

After the applicant submits the form, Heartpaydays.com reviews the application and selects appropriate lenders that suit the preferred terms and conditions. At this stage, some lenders under the network of Heartpaydays.com may evaluate the borrower’s creditworthiness with the help of external credit checking services.

Receiving the loan

After all the appropriate credit checks and identity verification has been complete, it is time for the borrower to receive the amount in his/her specified US bank account. The time for receiving the loan ranges from one day to 5 days depending on the lender chosen.

How to find the best-guaranteed installment loan rates in the USA?

Traditionally the credit market was dominated by banks and financial institutions which provided loans based on an individual’s credit score or history. That all changed with the introduction of internet connectivity and the emergence of several lenders and brokers offering installment loans for bad credit. Today, a simple Google search query such as “no teletrack installment loans direct lenders 100 approval” will yield a myriad of different bad credit installment lenders offering loans at different rates. Individuals may choose their preferred loan plan after selecting a lender that they may see fit.

However, borrowers are advised to search for lending brokers instead of direct lenders for a variety of reasons. There are several brokers such as Heartpaydays.com which help applicants navigate the complex landscape of lending institutions. Brokers generally have more knowledge of this market compared to someone who is merely shopping for better loan deals online.

Another advantage of signing up with a lending broker such as Heartpaydays.com is the huge network of lenders it provides. This offers opportunities for loan applicants to get the best loan rates possible. A broker might charge a small fee for this service. Choosing a broker like Heartpaydays.com helps individuals to steer clear of lenders that create debt traps for unsuspecting loan applicants.

Conclusion

With the current economic position of many individuals around the country in peril due to the coronavirus pandemic, installment loans for bad credit emerge as a viable way out. But simply applying for any lender won’t be helpful as one may end up in even more financial trouble. This is why it is always advised to conduct extensive research into the loan terms before signing up. Choosing a broker like heartpaydays.com will ensure that the applicant gets favorable loans from a network of reliable lenders. They will no longer be at the mercy of a single lender and thus out of reach for any debt trap-like situation. Choosing a broker provides more transparency and efficiency to the whole installment loan application process.

FAQs

Why choose guaranteed installment loans?

Guaranteed installment loans are financial products that help individuals tackle unexpected and emergency expenditures. Sometimes these guaranteed installment loans may be the only available means of financial support for some individuals who are prevented from applying elsewhere. One of the greatest examples of individuals taking installment loans is the communities affected by natural disasters.

Installment loans can be taken for other reasons as well, such as sudden medical expenses, cost of living when one is a student as well as debt consolidation.

Where can I get a guaranteed installment loan with bad credit?

Guaranteed installment loans can be accessed for a variety of different lenders and brokers offering APRs ranging from 5.99% to upwards of 35%. A simple Google search will yield thousands of options for individuals to choose from.

Alternatively, a borrower can choose a broker like Heartpaydays.com to save him/herself, the trouble of individually applying with every lender to shop for the best rates. The broker offers a consolidated platform where one is supplied with several options from different lenders.

Can I Have Multiple Guaranteed Installment Loans?

While many lenders do provide the opportunity for individuals to take out more than one guaranteed installment loan at a time, it is not an encouraged practice. As these loans typically come with higher APRs, individuals will find themselves paying substantially more in interest payments compared to what they would normally do if they took out the loan at once. This is why applicants should be absolutely certain about the amount they are requesting. Many lenders provide the opportunity of paying back the loan before its repayment schedule, allowing borrowers to save substantially on interest payments.

How Do I know if a Lender is Legitimate or a Scam?

The easiest way to evaluate whether a lender is legitimate or a scam is to research online. Borrowers will get the online footprint of numerous online lenders once they generate a simple search query. From here they will get customer testimonials, reviews, and recommendations which can help them shorten their choices. Any broker or lender that is chosen should conform to local state and federal laws of the United States.

Where Can I Get A Guaranteed Bad Credit Loan in the US?

US citizens can get access to bad credit installment loans through a variety of brokers and lenders. These lenders offer different terms and repayment options for applicants and are usually granted without the need for performing credit checks. Alternatively, there are lending brokers that work with a network of lenders to provide the best possible loan deal to their clients.

How can I apply for guaranteed installment loans for bad credit near me?

To apply for a bad credit installment loan, a borrower has to simply go online, select a lender, and register with it. The lender may ask for personal details from the borrower including valid documents, bank account details, and a working email address. Lenders of bad credit loans usually have less stringent requirements which allow low-credit-worthy individuals a fair chance of accessing credit.

How Can I Apply For Bad Credit Loans?

To apply for bad credit loans with a broker like heartpaydays.com, applicants have to first provide their age proof, valid phone number, email address, and a working bank account. Heartpaydays.com then asks its applicants to mention the amount they would like to request. After submitting, the applicant will eventually get a notification confirming or rejecting their loan application. If the loan application is accepted, the borrower will receive the loan amount within one to five working days, depending on the borrower’s bank.

Is a Bad Credit Loan Right For Me?

A bad credit loan should only be applied by individuals after he/she has exhausted all other forms of accessing credit. Alternatively, there are other alternative reasons for applying for installment loans for bad credit. Some of the most common reasons for taking out this form is a loan is to pay for an unexpected purchase, to tackle a misaligned cash flow, for a planned purchase, or when an individual’s expenses regularly exceed the income.

How do installment loans affect your credit?

Making on-time payments to lenders will certainly help an individual’s credit score as it can prove that he/she has the resources to pay back a line of credit on time. In many cases, moving credit card debt onto installment loans for debt consolidation reduces an individual’s credit utilization ratio. This is a huge factor in evaluating one’s credit score. However, failure to make payments on time or delayed payments by more than 30 days can seriously hamper one’s credit score and future credit accessing abilities.