If you’re struggling to make ends meet, you’re not alone. Thousands, actually millions of Americans, are in the very same boat. For many Americans, same day installment loans no credit check save the day by bridging the gap from one payday to the next. Sometimes it’s not even about bridging a gap from one paycheck to another but about affording one of those hefty expenses that come out of the blue. With same day installment loans direct lenders online quickly and easily available, you can pay the expenses you need right now, pay off the loan quickly, and get back on your financial feet once more.

With this in mind, this overview analyses the various types of installment loans same day deposit that are available online, including same day tribal loans. Here you will learn what these loans are, how they work, their features and pros/cons, the eligibility criteria, and how to apply for one. Once you’ve read through this, you’ll know everything you need about same day installment loans to make an educated decision.

What Are Same Day Installment Loans & How Do They Work?

Financial worries are no match for same day installment loans no credit check*. These loans are designed to pay out quickly. They’re usually small loans that the borrower can quickly and easily repay. The loan model is easy to understand when applying for same-day loans through Heart Paydays. A lump sum is provided to the borrower, which is then paid back over a set period in monthly installments. Applying for installment loans online same day is easier than you think and takes just a few minutes.

While on the Heart Paydays website, select the amount you wish to borrow, from $100 to $5000. You can also choose how long you need to repay the loan, typically over 3 to 24 months. Making these selections will present with a total loan amount, interest rate amount, and what you can expect to pay back in installments each month. To process your application for installment loans same day deposit via Heartpaydays.com, you must complete the online application form. The form gathers all the required information quickly, taking just a few moments. To get started, click on “Apply” and follow the prompts to complete the form. Of course, the steps to complete an application for same day installment loans online are featured further in this overview.

Disclaimer: Whilst Heart Paydays doesn’t check your credit, your credit may be checked by 1 or more of our lending partners and their third party credit bureau’s upon submission of your request, or at a later date. Further information can be found in our terms and conditions.

The operator of this website does not make any credit decisions. Independent, participating lenders that you might be matched with may perform credit checks with credit reporting bureaus or obtain consumer reports, typically through alternative providers to determine credit worthiness, credit standing and/or credit capacity. By submitting your information, you agree to allow participating lenders to verify your information and check your credit.

Types of Same Day Installment Loans

Luckily for borrowers, there are various types of installment loans online same day available to ensure that a wide array of needs and requirements can be met. Below is a brief list of the various types of same day funding installment loans you can access online via the Heart Paydays website.

Same Day Installment Loans Direct Lenders Online

Of course, you don’t want to be pushed from pillar to post when looking for same day installment loans online. And the team at Heart Paydays understands this. When we present you with loan options to consider, we put you in direct contact with the lender or broker offering the deal. This means that everything can be finalized quickly and easily. Installment loans that are paid out on the same day and through direct lenders or brokers range from $100 to $5000 and come with 3 to 24 months to pay.

Same Day Tribal Loans

Same day tribal loans are usually set in place by those with poor credit or who cannot get approval from the local bank. Same day tribal loans are easier to set in place than regular personal loans. The only catch is that interest can sometimes be up to 400% and beyond. When looking for a great alternative, you will find that loans are just as easy on the Heart Paydays website, and the interest is affordable at 5.99% to 35.99%.

Same Day Installment Loans Bad Credit

Bad credit borrowers tend to be hesitant when applying for loans. In some instances, same day installment loans online are easier to get with a low credit score than other types of traditional loans.

There are several installment loans same day deposit that can actually be used to rebuild your credit. You can do this by taking out small same day installment loans and ensuring that you repay them on time and in full. Heart Paydays is a loan-finder service and, as such, will never check your credit. That said, various lenders on the panel at Heartpaydays.com may do a credit check to verify if you’re credit-worthy.

Same Day Installment Loans No Credit Check*

Everyone with a less than perfect credit score spends time looking for same day installment loans no credit check*. This is because most believe that credit checks are the sole determining factor regarding loan approvals. While lenders may carry out a credit check against your name, you may find that your credit score is not the only factor influencing your loan outcome. When you apply for loans of this type, you stand to benefit from loans ranging from $100 to $5000 with 3 to 24 months to pay.

Installment Loans Same Day Deposit

What’s worse than having financial troubles? Applying for a loan, waiting days for approval, and even more days for a payout – that’s what! The beauty about getting loan approval through the Heart Paydays site is that the loans are quick and easy to apply for, and if you get approved for a loan, you can expect the deposit to be made into your bank account on the same day. This is the beauty of installment loans same day deposit! At Heartpaydays.com, same day loans range from $100 to $5000 with an interest of 5.99% to 35.99%.

Features Of Same Day Installment Loans

Knowing what to expect from same day installment loans online can simplify the process. Most same day installment loans direct lenders online via Heart Paydays have the following features in common:

Simple Online Application

Applying for same day funding installment loans online via Heartpaydays.com is quick and easy. The entire process is managed online, and this means you won’t have to leave your house or go anywhere to process your application. You only need a mobile phone, laptop, desktop, or internet-connected device to process your application.

Money Paid Into Your Account On The Same Day

There’s no waiting around for cash to be paid into your bank account when approved for a loan at Heart Paydays. That’s because most of the lenders on the Heart Paydays panel offer installment loans same day deposit. In most instances, the same day funding installment loans pay out within 60 minutes of approval, but there are instances where borrowers have to wait until the next business day to get the cash they need (24 hours).

5.99% to 35.99% Interest

Interest is an essential part of the process when deciding if a loan is ideal for your financial situation or not. Therefore, it’s expected that same-day lenders online charge more interest than the traditional bank. You will find that the same day installment loans via Heartpaydays.com have interest that ranges from 5.99% to 35.99%.

Examples of Installment Loans Same Day Funding Via Heartpaydays.com

What can you expect when it comes to installment loans same day deposit? View some basic examples of instant funding installment loans below. Consider the examples to have a better idea of the loans available when using the Heartpaydays.com loan-finding service:

| Lender | APR | Loan Amount | Min Credit Score | Funding Time |

| LendUp | 30.00 – 180.00% | $100 – $500 | None | 24 hours |

| Avant | 9.95% to 35.99% | $2,000 to $35,000 | 580 | 24 hours |

| Rise Credit | 50.00 – 299.00% | $500 – $5,000 | None | 24 hours |

These are just examples and are subject to change.

Advantages And Disadvantages Of Same Day Installment Loans

There are several advantages and disadvantages linked to same day installment loans as follows:

Advantages of Same Day Installment Loans

Quick Access To Cash

Being able to get cash in a hurry can provide exceptional relief when you’re in a tough financial spot. When getting a loan through the Heart Paydays portal, you can expect to get the cash on your approved loan paid out within a few hours. In most instances, the wait isn’t longer than the next business day. Quick access to cash is a welcomed financial relief – and that’s the beauty of same day installment loans.

Applicants Don’t Have To Be Employed

You may think it strange that lenders can provide installment loans same day funding to unemployed individuals, but it’s true – they can! If you want to apply for installment loans online same day, you must earn a minimum income of $1000 per month, but that income does not need to come from a traditional bank. Instead, you can make your income from dividends, rental of property, freelance earnings, allowances, or trust payouts, to name a few alternatives.

Absolute Discretion Throughout The Process

A great benefit of applying for Heart Paydays’ same day funding installment loans is that the entire application process is discreet. You never need to worry about your application for same day installment loans online being discussed with anyone else and if lenders cannot assist you with a loan, that is entirely your business too.

Disadvantages Of Same Day Installment Loans

Expensive Borrowing Option

It is no secret that same day installment loans bad credit is not the cheapest form of borrowing. These online loans come with less red tape than the local bank, but that sort of convenience comes at a cost. The cost of same day funding installment loans is affected by high-interest rates, which typically range from 5.99% to 35.99%.

Do You Qualify? Eligibility Criteria Of Same Day Installment Loans!

The consensus is that same day funding installment loans and installment loans same day deposit are simple to get through Heart Paydays. While that is true, it’s important to note that all applicants must still meet the minimum requirements to qualify for the same day installment loans online. To qualify for same day installment loans, you must meet these requirements:

- 18 years of age minimum

- US citizens or legal residents

- Valid ID and Social Security Number

- Proof of address

- Minimum monthly salary of $1000 per month

- Supply supporting documentation: bank statements (3 months) pay stubs (3 months)

- A bank account and active US mobile number

Apply For Same Day Installment Loans Online In Four Quick Steps

To apply for installment loans same day funding using the Heartpaydays.com loan-finder service, you only need a few minutes of free time. The online automated system is designed to simply the process and all you need to do is follow the prompts. That said, below are 4 simply steps to help you apply for instant funding installment loans online.

Step 1: Indicate How Much You Need To Borrow

You can borrow between $100 and $5000 with same day installment loans at Heart Paydays. Before applying for a loan, using the convenient loan calculator included on the website is a good idea. Simply input how much you wish to borrow and then use the slider to select how many months you want to repay the loan. The information presented will indicate several important details: how much you’re borrowing, the APR, and when you can expect the cash in your account.

When using Heartpaydays.com to find a loan, you can expect the lenders to offer interest rates ranging from 5.99% to 35.99% and repayment terms of 3 to 24 months.

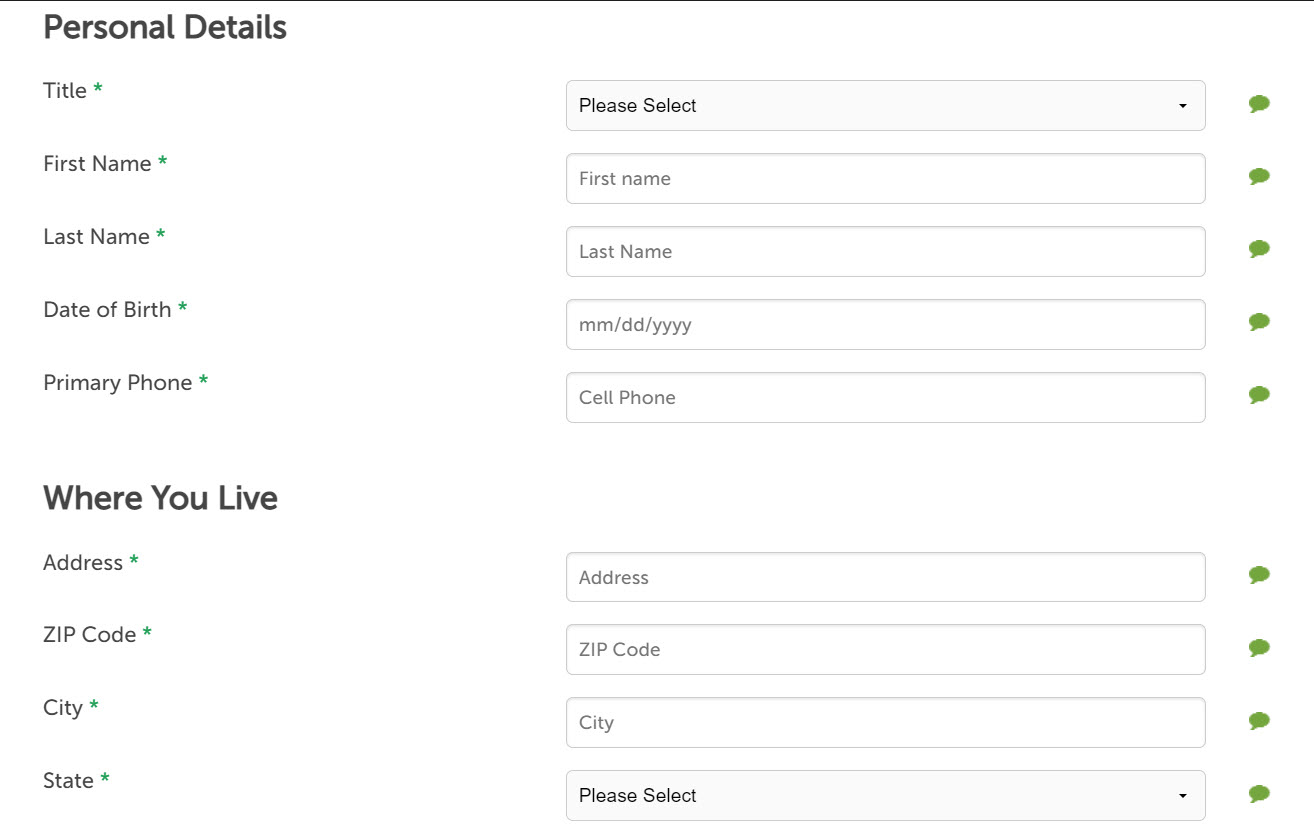

Step 2: Fill Out The Application Form Online

To keep things streamlined and convenient, the Heartpaydays.com application form is a digital form you can complete on the website. To access the form, click on the big red “Apply” button at the top right-hand corner of the screen. Completing the same day installment loans application form will take only a few moments, and it’s all quite simple – you only need to follow the prompts. You will need to provide your full name, ID, address, banking details, employment details, and more.

Step 3: Wait Two Minutes For An Outcome

The world is about getting what you want right now, and it’s much the same in the loans industry. But, of course, you don’t want to be kept waiting for results on your loan application and don’t need to be. With same day funding installment loans, outcomes are provided within just 2 minutes of application. And if you like what lenders have to offer you, you can elect to finalize the deal directly with the lender.

Step 4: Get Your Loan Agreement & Get The Money

The last step involves the lender presenting you with a loan contract that stipulates the terms and conditions of the same day installment loans. At this point, you should make it your duty to read through the agreement and then ask as many questions as is necessary to ensure that you fully understand the loan and how it will impact your life going forward. Only sign the loan agreement if you are genuinely happy. The lender may request further supporting documentation, but when satisfied, they will approve the loan and pay out the funds. Funds are usually received on the same day the loan is approved or by the next business day.

FAQ’s

Are There No-Credit-Check Same Day Installment Loans?

Some lenders in the US offer no hard credit check on applicants’ credit scores. That said, a lender that advertises that they do no credit check may be unscrupulous in the end – and you may find yourself unable to pay the loan back. For example, while Heart Paydays doesn’t carry out credit checks on borrowers, the lenders offering the loans in the end might.

Can I A Loan On The Same Day?

Yes! Same day installment loans ensure you get the cash you need within a few hours of your loan approval. At most, borrowers may wait until the next business day to get the money they need.

Why Do Online Lenders Pay Out On The Same Day? What’s The Catch?

Same day installment loans are paid out on the same day to provide the borrower with the convenience they’re looking for. Of course, such convenience comes at a cost – same day loans are not the cheapest form of borrowing!

I Earn My Income From Rental Properties But Don’t Have A Job. Am I Eligible For Same Day Installment Loans?

Yes, you are eligible for same day installment loans. You have to earn a minimum of $1000 per month. And the good news is that you don’t have to be traditionally employed to be considered a viable candidate for a loan. You can prove your income by presenting your bank statements and tax returns.

Which Apps Give Loans Instantly In The USA?

Instant loans, or same day installment loans as they are otherwise called, are readily available through the Heartpaydays.com portal. Input how much you wish to loan and how long you want to pay it back over and get the opportunity to apply for a loan in a few minutes. Most payouts are on the same day the loan is approved or by the next business day.

What Can I Use Same Day Installment Loans For?

Same day installment loans provide funds to cover expenses when you’re in a tight financial spot. Borrowers can get same day installment loans online for unexpected expenses such as vehicle repair or medical costs. You can also use same day installment loans for home repairs and rent. That said, you can use your same day installment loans payout for anything you want.

How Do Same Day Installment Loans Work?

Same day installment loans are short term loans that provide a borrower with a lump sum of money upfront. The loan is then repaid in fixed monthly installments. Depending on the loan amount and the lender, the loan term can be for just a few months or a few years. The amount that is repaid is the loan amount plus interest. In the case of same day installment loans via Heart Paydays, interest can range from 5.99% to 35.99%.

Which Online Installment Loans Have The Lowest Interest Attached?

Finding low-cost loans can be hard nowadays. In fact, in some instances with same day tribal loans or same day installment loans bad credit, the interest can be as much as 400% or even higher! When using the Heart Paydays loan-finder service, you can expect interest of between 5.99% and 35.99%.

How Long Do I Get To Repay Same Day Installment Loans Online?

The repayment period depends on the lender, how much you have borrowed and, of course, your financial situation. The lender will collaborate with you to determine a repayment period that works well for both of you. When using the Heartpaydays.com loan finder service, you can expect repayment terms to range from 3 to 24 months.

Disclaimer: Whilst Heart Paydays doesn’t check your credit, your credit may be checked by 1 or more of our lending partners and their third party credit bureau’s upon submission of your request, or at a later date. Further information can be found in our terms and conditions.

The operator of this website does not make any credit decisions. Independent, participating lenders that you might be matched with may perform credit checks with credit reporting bureaus or obtain consumer reports, typically through alternative providers to determine credit worthiness, credit standing and/or credit capacity. By submitting your information, you agree to allow participating lenders to verify your information and check your credit.